Cementos Moctezuma – Analysis and Valuation

A deep dive on the Mexican cement industry and one of the most profitable cement companies in the world.

40 minute read

Why is it worth analyzing Cementos Moctezuma?

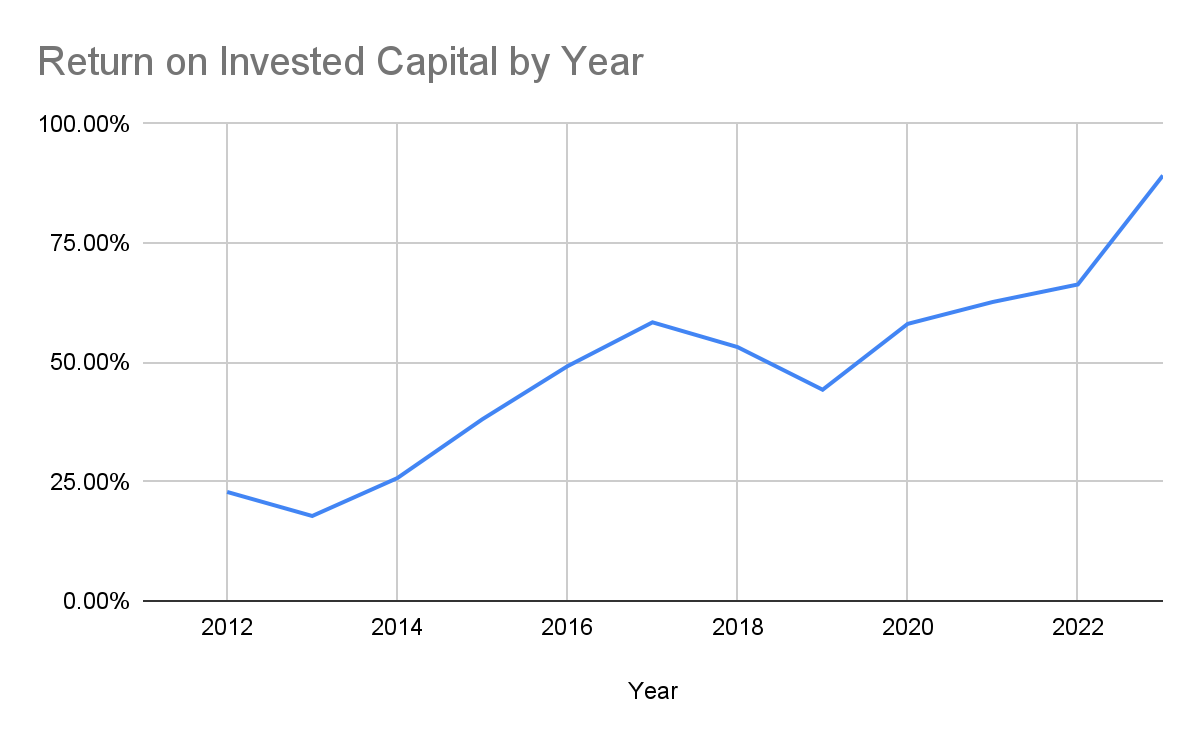

Cementos Moctezuma is a highly profitable unleveraged business–in the past 5 years, it generated an average return on invested capital of 59%.

The company enjoys competitive advantages in production scale and distribution, thanks to its production capacity, location of cement plants and quarries, and the relationships it has built with railway operators that allow it access to railway spurs to load cement directly in its plants.

Today, the company sells at 10.2x earnings. This might be an attractive price for a business that is highly profitable, has significant excess cash, operates in an oligopolistic market with high barriers to entry, and has the potential to grow its earnings into the future.

Short to mid-term, the company is position to benefit from a potential increase in the production of homes and the mixed-use of the new Mayan Train in the southeast region of the country. Long term, the cement industry will continue to benefit from Mexico’s demographics, which will drive the demand for housing and infrastructure development.

Market Valuation of Cementos Moctezuma

Share Price: MX $75

Shares Outstanding: 857,435,780

Equity Market Cap: MX $64,307 million

Cash: MX $7,059 million

Total Debt: MX $169.8 million

TEV: MX $57,417

TTM Net Earnings: MX $6,165 million

TTM FCFF: MX $5,636 million

TTM P/E: 10.4

EV/TTM FCFF: 10.2

Please note that FCFF is understated, as capex in 2023 was greater than maintenance capex or necessary investments in long-term assets to operate the company’s business.

Analysis Outline

Business Understanding

Industry Understanding

Market Dynamics and Competitors

Determinants of Profitability

Barriers to Entry

Potential Foreign Competition

Analysis of Operations of Cementos Moctezuma

Cement Business

Concrete Business

Distribution

Analysis of Profitability

Revenue

Operating Profitability

Invested Capital

Capex

Free Cash Flow

Return on Invested Capital

Profitability of Cementos Moctezuma vs Competitors

Competitive Advantages

Durability of Business

Potential Growth

Increase in Home Production

Access to New Railway Line (“Tren Maya”)

Production Capacity vs Production

Sustainable Earnings Power Valuation

Discounted Cashflow Valuation

Margin of Safety

Downside Protection

Conclusion

Business Overview

Business Understanding

Cementos Moctezuma is a Mexican company that produces, distributes, and sells Portland cement and pre-mixed concrete. The company sells cement in the form of individual packages and bulk to construction companies and distributors in Mexico. The company sells pre-mixed concrete to construction companies via a scheduled delivery.

The company is vertically integrated in the production of cement. They own 3 plants, located in Tepetzingo, Cerritos, and Apazapan, with a combined installed capacity of 8 million tonnes of cement. All plants have quarries next to them that can supply over 100 years of material for cement production.

In 2019, revenue was divided as 84.90% from the sale of cement and 15.10% from the sale of pre-mixed concrete. Nationwide, the company holds a marketshare of 15% and 5% in the markets of cement and concrete, respectively.

Company History

The company was founded in 1982 by Fratello Buzzi (now Buzzi Unicem SpA), Mexican company Coconal and Mr. Óscar Alvarado when they acquired Cementos Portland Moctezuma, whose origins trace back to 1943 when the first plant was built in the state of Morelos.

The company has grown through acquisitions and the creation of new cement plants and production lines that have increased production capacity.

In 1987 Cementos Moctezuma acquired Latinoamericana de Concretos (Lacosa). In 1988 the Spanish company, Cementos Molins, invested in Moctezuma and they consolidated operations from cement and concrete in Corporación Moctezuma, which listed itself that year.

In 1997, the Tepetzingo plant started operations with an installed capacity of 1.25 million tonnes of cement. Three years later a second production line was built, increasing capacity to 2.5 million tonnes of cement.

In 2004 the Cerritos plant started operations, with an installed capacity of 1.3 million tonnes of cement. The plant had a cost of $151 million dollars. Two years later they doubled the installed capacity of the Cerritos plant to 2.6 million tonnes of cement.

In 2007 the company approved a significant investment of $265 million dollars for the construction of a third plant in Apazapan, in the state of Veracruz with an estimated capacity of around 1.3 million tonnes of cement. The plant in Apazapan started operation in 2011. In 2016 the company increased production capacity to 2.75 million tonnes through the construction of a second production line.

Shareholders

Today the principal shareholders of the company are Buzzi Unicem SpA and Cementos Molins (66.7%), and Antonio Cosío (10.3%).

Cementos Molins and Buzzi Unicem are two Spanish and Italian companies, respectively, that own 50% each of Fresit BV and Presa International BV.

Buzzi Unicem is an Italian producer and distributor of cement. The company is very profitable and also practically debt-free.

Board

It is worth noting the influence that Buzzi and Molins have over how the company is managed. Enrico Buzzi is the former chairman of Cementos Moctezuma and currently serves as the CEO of Buzzi Unicem. Salvador Fernández Capo is currently the chief Chief Operating Officer of Cementos Molins.

Industry Understanding

Market Dynamics and Competitors

The cement industry in Mexico has historically been dominated by a handful of companies.

Between 1948 and 1980, competitors included Cementos Mexicanos (CEMEX) in the north-east with 15% marketshare; Cementos Guadalajara in the south-west with 11% marketshare; Grupo Tolteca, in the center with 25.7% marketshare; Grupo Anáhuac in the center and golf of Mexico, with 15% marketshare; San Luis Mining Company, in the Pacific, with 4% marketshare; and Cementos Cruz Azul, in the south and south-east part of the country, with 11% marketshare.

During the 1980s, the industry consolidated through mergers and acquisitions.

In 1987 Cementos Moctezuma acquired Latinoamericana de Concretos (Lacosa).

In 1987, Cemex acquired Cementos Anáhuac, which at the time had a 13% marketshare through two cement plants located in the state of Mexico and San Luis Potosí, with an annual capacity of 4.5 million tons. Through this acquisition, Cemex increased its production capacity to 15.2 million tons, equivalent to 48% of the country's total capacity.

In 1989 Cemex acquired Empresas Tolteca, a company with an annual cement production capacity of 6.7 million tons. At the time, Tolteca was owned by Mexican construction company ICA and English cement company Blue Circle. Cemex paid US $95 per ton of installed capacity for the company. In addition to the cement plants, Tolteca owned the most important network of concrete plants in the country and port terminals to export cement to the US. As a result, the acquisition of Tolteca not only allowed Cemex to increase its production capacity but also strengthened its distribution scale.

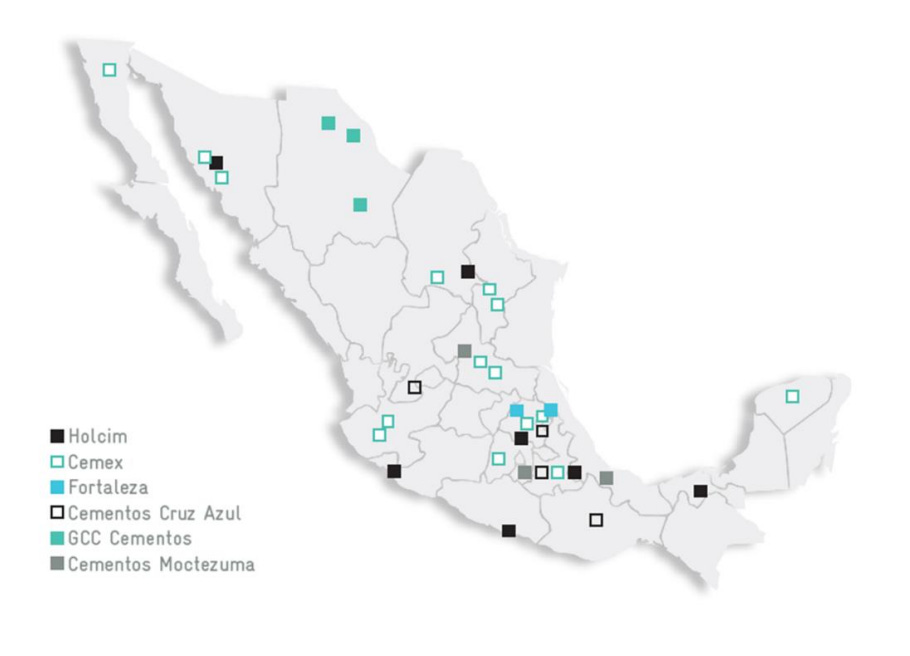

Today, the Mexican cement market continues to be characterized by a few dominant companies: Cemex, with a global footprint and 43% marketshare; Cementos Moctezuma, a strong domestic player with 12% marketshare; Holcim Apasco, part of the global Holcim group with 20% marketshare; Grupo Cementos de Chihuahua (GCC) with 3.5% marketshare; Cementos Cruz Azul with 15.2% marketshare; and Cementos Fortaleza with 5.6% (Grupo Carso and Mexichem).

The market has a total installed capacity of 65.8 million tonnes. This compares to a production of 49.9 million tonnes, and a consumption of 47.8 million tons in 2022.

The following image illustrates the existing cement plants across the country and the respective cement companies that own them.

It is an oligopolistic market, with high barriers to entry given the significant capital investments necessary to achieve economies of scale in production capacity and distribution to successfully compete. In the past 70 years, only one new competitor has entered the market. Hundreds of millions of dollars are required to build a cement plant. Furthermore, because cement is a low-value high-volume product, efficient transportation is critical, the cost to transport cement is high and does not allow it to be profitably transported over long distances. As a result, cement plants need to be strategically located near urban centers (end market), and raw material quarries.

Due to the logistical constraints of cement, cement exports have not represented a significant percentage of cement production. Only around 3% of the cement produced in Mexico is exported. Generally, companies that want to expand their operations to new countries acquire or merge with existing companies; or install cement plants inside those markets.

The growth of the cement industry in Mexico has been influenced by both domestic and international factors. Domestically, the demand for cement has been closely tied to the construction sectors, which are influenced by urban development projects, housing, and infrastructure.

75% of cement in Mexico is sold in packages of 25 to 50 kilos, which is more expensive than bulk.

Related to packaged cement is the auto construction industry, which refers to the self-build practices prevalent among Mexican households. Autoconstruction represents a significant portion of residential construction in Mexico, with families gradually building or expanding homes as financial resources become available. Cement companies have strategically catered to this market segment by offering products and solutions tailored to the needs of self-builders, including bagged cement, ready-mix concrete, and construction guides.

Of the 35.2 million total homes in Mexico, 57.3% were auto-constructed. This sector's demand for cement and related products is a significant driver of the industry's domestic sales.

In recent years, the development of new infrastructure projects from the current administration, including the new airport of Santa Lucia in Mexico City and Tren Maya, have benefited the domestic demand for cement.

Determinants of Profitability

The most important operating factors that contribute to the profitability of a cement company are being able to achieve economies of scale in terms of production capacity, having low transportation costs, and optimizing energy costs.

Economies of scale in production capacity are achieved by being able to produce significant amounts of cement, to distribute the fixed costs of a plant over a greater number of units. Moreover, having access to high-quality raw materials and sourcing determines the company's ability to maintain lower production costs. Companies that own the quarries to extract raw materials for cement have a cost advantage.

Cement is a local business because of the logistical costs to transport the material. The distance between the raw material quarries, cement plant, and end market needs to be small for a cement company to compete effectively. Cement can be profitably transported in a radius of 400km from the plant through freight trucks. Large cement companies have been successfull in incorporating rail as a transportation method to reach new markets far from the cement plant–up to a 900km radius. Low transportation costs are thus achieved by having access to raw materials near or next to the plant, proximity to the end market, and railway as a transportation method.

Low energy costs are achieved by optimizing fuel source, using advanced and fuel-efficient machinery, and having access to cheap energy. For example, in 2004 Cementos Moctezuma replaced oil with Petcoke as an energy source to power the kilns that make clinker. As a result, the company was able to reduce energy costs by 60%.

Barriers to Entry

The necessary capital and know-how required to build a cement plant act as barriers to entry for new competitors. Companies that wish to enter the market and develop a small to medium-sized cement plant that generates between 800,000 - 1.3 million tonnes of cement must invest between US $150 - US $250 million. For example, in 2015 Cementos Fortaleza invested US $250 million to expand production capacity by 1.5 million tonnes through the development of an additional production line.

Furthermore, competitors that wish to enter the industry must find a location that is close to the end market, complies with environmental regulations, and has access to a nearby quarry to reduce logistical costs. Environmental regulation and lack of available locations have increased the value of available plots, making it harder for new competitors to enter the market.

Potential Foreign Competition

Mexico imports a relatively small amount of cement compared to its exports. In 2022, the value of cement imports was only US $23 million. Reasons for the lack of significant foreign cement imports are strong domestic competitors, surplus production that can lead to a price war, and the logistical costs associated with transporting cement.

Analysis of Operations

Cement Business

As previously mentioned, the company owns 3 cement plants that mainly serve the center, southwest (“bajío”), and southeast region of Mexico.

The Tepetzingo plant, built in 1997, and located in the state of Morelos, near the city of Cuernavaca, can produce 2.5 million tons of cement annually. This plant is next to the Eje Metropolitano highway, which allows the company to efficiently transport cement by truck. An added benefit of the location of this plant is its proximity to Mexico City–109 km distance.

Location of Tepetzingo Plant:

Tepetzingo Plant:

The Cerritos plant, built in 2004 and located in San Luis Potosi, can produce 2.75 million tons of cement annually. This plant has access to a railway spur to directly load cement onto a railway to more efficiently transport cement. Moreover, the plant is next to the ‘Autoposita Rio Verde’ highway, which allows it to efficiently distribute cement by truck to the center of the country.

Cerritos Plant:

Zoom In of Railway Spur at Cerritos Plant:

The Apazapan plan, located in the state of Veracruz, can produce 2.75 million tons of cement annually. This plant started operations in 2010 and allows the company to profitably sell cement in the southeast region of Mexico (Campeche, Chiapas, Quintana Roo, Tabasco, Veracruz, and Yucatan), thanks to its access to a railway spur. The company uses the railway to transport 30-40% of the cement produced.

Finally, this plant is next to a highway (“Carretera Villa Emiliano Zapata”), which allows it to also efficiently transport cement by truck.

Location of Apazapan Plant:

Apazapan Plant:

Railway Spur in Apazapan Plant:

Zoom In of Railway Train in Apazapan Plant:

In total, the company has the capacity to produce 8 million tons of cement annually.

The company sells cement in bulk directly from its plant and in packaged form to its network of independent distributors. The company's distributor network allows it to meet the demand of the auto construction market.

Concrete Business

The concrete business suffers from low barriers to entry given the small capital requirements necessary to build a concrete plant and compete. This has caused margins to decrease as more competitors have entered the industry.

To protect the profitability of its concrete operations, since 2013 management adopted a strategy to prioritize profitability over geographical coverage by reducing its operations in less densely populated areas to concentrate on the most important cities where it operates. This strategy has benefited the company. In some cities, the company now produces the same amount of concrete with fewer plants.

Furthermore, management also focused its operations on projects that small concrete companies cannot compete in, like large commercial and infrastructure projects that require significant amounts of concrete.

Today the company owns 31 concrete plants and 238 mixer trucks that are used to transport concrete.

The company's concrete client base primarily includes construction infrastructure companies, home builders, commercial construction companies, and retail customers that participate in the auto-construction sector. The company does not have a single client that currently represents more than 10% of sales.

Distribution

The company distributes the cement it produces through its network of independent distributors, concrete operations, and directly to customers from its plants.

As for transportation methods, the company currently transports 80% and 20% of the cement it produces by truck and railway, respectively.

The use of the railway has allowed the company to efficiently sell its cement in the southeast region of Mexico. Previously to the opening of the Apazapan plant, the company transported cement to the southeast region directly from the Tepetzingo plant located in the state of Morelos, via truck.

Analysis of Profitability

Revenue

From 2011 to 2023 revenue grew at a CAGR of 7.5%, driven by investments to expand production capacity, development of railway terminals to reach new markets in the southeast region of the country, growth of the construction industry in Mexico, strong demand for cement from big government infrastructure projects, and price increases.

Notable Events

Decrease in revenue in 2013 due to the crisis in the housing sector in Mexico

Increase in revenue in 2015 due to strong construction demand from housing and commercial projects, and greater use of production capacity.

Increase in revenue in 2016 from the expansion of production capacity from the conclusion of the development of the second line of the company's Apazapan plant.

Decrease in revenue in 2018 and 2019 from the pause and cancellation of important construction projects by the new administration. An increase in uncertainty reduced construction investments from the private sector.

In 2020 the industry experienced a significant decrease in economic and construction activity from COVID. Demand for cement was offset by the large infrastructure projects from the government.

In 2023 revenue increased as a result of price increases to pass inflation to clients. The construction industry benefited from a more stable environment and economic optimism from nearshoring, appreciation of the Mexican peso, and lower inflation.

Operating Profitability

As part of the company’s strategy to prioritize profitability over geographical footprint, concrete as a percentage of revenue decreased from 25% in 2013 to 15.1% in 2019. During this period, revenue from concrete remained constant, changing from MX $1,997 million to MX $1,931 million; meanwhile, revenue from cement increased significantly–from MX $5,961 million to MX $10,855 million.

Between 2016 and 2023, after the opening of the second production line of the Apazan plant, the company’s operating and net margins averaged 40.8% and 30%, respectively. In 2023 operating margin was 42.2%.

Invested Capital

Impressively, the company was able to grow revenue by 139% from 2011 to 2023 without requiring much additional capital. Invested capital decreased from MX $8,876 million to MX $6,500 million during the period, thanks to working capital optimizations. Non-cash working capital decreased from MX $2,283 million to MX $-936 million during the period. PP&E remained relatively the same, from MX $7,025 million in 2011 to MX $7,028 million in 2023.

From 2011 to 2023, the company returned excess cash in the form of dividends and share repurchases, averaging a payout ratio of 96% and paying a total of MX $40,478 million.

Capex

Historically, D&A has been higher than capital expenditures during periods of no investments to expand production capacity. From 2012 to 2023, D&A as a percentage of revenue averaged 4.5%, I estimate this number to be a good representation of the necessary investments that the company must make each year in long-lived assets to maintain operations.

Free Cash Flow

Taking into account necessary investments in long-lived assets and changes in non-cash working capital, we observe that the company is a significant generator of cash. From 2016 to 2023, FCFF as a percentage of revenue averaged 30%.

During the same period, free cash flow increased at a similar rate to revenue, with a CAGR from 2012 to 2023 of 8.3% vs 7.5% for revenue, respectively.

Return on Invested Capital

Between 2016 and 2023, the company averaged a return on invested capital of 59%, demonstrating its superior economics. During this period, ROIC benefited from an increase in production capacity from the development of the second production line in the Apazapan plant, which allowed the company to achieve greater economies of scale by spreading the fixed cost of its plant in greater units, and optimizations in working capital. The following graphs show how the company’s ROIC by year from 2012 to 2023.

Competitive Advantages

Cementos Moctezuma has competitive advantages in production scale and distribution thanks to its production capacity, location of cement plants and quarries, and the relationships it has built with railway operators that give it access to railway spurs to load cement directly in its plants.

Regarding production scale, the company benefits from economies of scale in each of its 3 plants. On average it has a production capacity of 2.6 million tons per plant, which is greater than most competitors.

The location of its plants allows it to be a low-cost producer because it can access high-quality raw materials at a low cost thanks to the closeness of the quarries to its plants.

Furthermore, all of the company’s plants are strategically located near end markets with strong demand for cement through the segments of infrastructure, housing, and commercial developments. The company can profitably sell cement in the center, southwest, and southeast regions.

As for distribution, the company's extensive distributor network in areas with high demand for autocontrusction and public works allows it to be closer to clients and position its brand.

Finally, having access to railway as a transportation method is also a significant competitive advantage for the company. It is 30-40% less expensive to transport cement by railway than by truck. A railway can transport up to 100 tons of cement while a truck can transport up to 36. Furthermore, while cement companies can only efficiently transport cement to a radius of 400 km from the plant via truck, through railway this distance increases to 900 km, allowing the company to reach new markets.

Competitors that want to take advantage of railway as a transportation method need to have their plants close to railway lines, invest significant capital to develop railway infrastructure to transport their product and operate with sufficient scale for railway companies to want to develop railway spurs to efficiently load cement. For example, the management at Cementos Fortaleza mentions that they are only able to transport 2% of their product through rails, even though it's cheaper than trucks because their plants do not have access to railway spurs.

Durability of Business

The necessary capital requirements to establish a cement plant have historically deterred new competitors from entering the industry. In the past 70 years only one new company has entered the market–Cementos Fortaleza founded in 2014, and backed by Carlos Slim and Antonio del Valle. To start, Cementos Fortaleza invested US $230 million to develop a cement plant from scratch next to a quarry with reserves to 99 years, and a production capacity of 600 million tonnes. Relative to the size of the cement plants from industry leaders like Cemex, Holcim Apasco, and Cementos Moctezuma, this is a small plant.

Going forward, I expect that the industry will continue to be dominated by a handful of competitors because of the capital requirements needed to compete.

Are current cement prices unsustainably high when considering the surplus in product capacity? Are prices likely to come down?

In 2023, Cruz Azul’s cement plant in Tula de Allende was not operational due to internal problems at the company. This plant has an estimated installed capacity of 2.5 million tonnes. Cement production will likely increase from 2023 levels once this plant becomes operational again, which can cause the price of cement to drop. In general economic terms, if the supply of a product increases while demand remains constant, the price of the product is likely to decrease.

Considering the domestic total installed capacity of 65 million tonnes vs production of 46.9 million tonnes, the industry only used 72% of total production capacity in 2023. This production level compares negatively with previous years–between 2005 and 2015 the average level of production capacity used was 84.1%.

An increase in production capacity of 2.5 million tons would increase production to 49.4 million tonnes, or 76% of installed production capacity.

Future Growth

Mexico Demographics

Mexico’s population is around 126 million people. Although population growth has slowed (Mexicans now on average have 2 children per couple). Mexico is a young country, 40% of Mexicans are 24 or younger and 58% of Mexicans are 34 or younger. By 2030 it is estimated that there will be 34 million Mexicans aged between 20 and 39 years, and most of them will need homes. The country’s population has more than tripled since 1960 and is projected to grow to 146.9 million by 2030–a 2.5% growth rate. This demographic structure offers the opportunity to seize a ‘demographic dividend,’ defined as the potential economic growth from having a large labor force and relatively few dependents to take care of. This by itself explains why demand for housing and government infrastructure projects should remain strong for the foreseeable future.

Is the production of new homes likely to increase from current levels?

INFONAVIT reports that today there is a shortage of housing available compared to the number of households being formed. It is estimated that the number of private homes in the country's 74 metropolitan areas increased from 22.2 million in 2010 to 26.4 million in 2020. This represents an average annual growth of 1.7% during the period. However, this growth seems insufficient compared to the increase in the number of households during the same period, which had an average annual growth of 2.5%.

Current levels of production of new formal homes are at a decade low because of government cuts to housing subsidies and decreases in mortgages granted by National Housing Agencies.

Semester Production in 2023: 60,800 (Registro Público de Vivienda).

A symptom of the current housing scarcity is price increases. The housing price index shows an increase of 53.7% from 2018 to 2023, compared to a 29.3% increase in the consumer price index and a 45.8% increase in the residential construction price index.

Considering that 58% of Mexicans are under 34 years old, the current housing shortage relative to households being formed, increases in home prices, and the fact that new housing production is at its lowest in the last decade, we maintain a thesis that home production must eventually increase to meet the country’s needs. A catalyst for this is a change in the government’s administration coming in the second quarter of 2024.

Increased use of Railway as a Transportation Method

The cement industry is posited to benefit from the development of the Mayan Train. This train will transport both passengers and cargo, which will give cement companies the ability to transport cement through the Yucatan peninsula at a low cost. As a result, cement companies with operations in the southeast region of Mexico will benefit from lower transportation costs.

The following graph shows the railway routes that the Mayan train will cover (purple line).

It is estimated that the Mayan Train could transport up to 3.6 million tonnes in 2024, and reach 8.4 million tonnes in 2033.

Corredor Interoceánico del Istmo

The southeast region will benefit from the development of the “Interoceanic Corridor of the Isthmus of Tehuantepec”, a trade and transit route that will connect the Pacific and Atlantic Oceans through a railway system. Analysts expect this government project to be the most important from AMLO’s administration, given the opportunity that this infrastructure has to compete with the Panama Canal. The government expects that this project will boost the economic development of the region. Ten industrial parks will be constructed around the new railway line. I expect that all the growth in economic activity in the region will benefit the cement industry.

Is the company positioned to benefit from the above?

Cementos Moctezuma is positioned to benefit from an increase in home production. The company serves the center (Valle de México) and southeast regions of Mexico, where demand for new homes is highest. The following graph illustrates home deficit by region, according to a report made by INFONAVIT.

Furthermore, we expect that Cementos Moctezuma will benefit from the conclusion of the Mayan Train. In 2019 the company transported 166,000 tonnes through the region covered by the train. This represents 23.4% of the total volume of goods transported in the region that the train will cover. In the short term, the benefit that this train will provide to the company is not significant, as the amount transported in 2019 only represents 2% of installed production capacity. Longterm, however, the company could leverage the railway lines of the Mayan Train to reach new markets that were previously unattainable because of transportation costs.

Also important, we believe the company is positioned to benefit from the economic development that the “Corredor Interoceánico del Istmo” will have in the southeast region of the country. This government project represents a great opportunity to compete with the Panama Canal and establish a great avenue for Asian companies t to reach the US. We expect that the company will benefit from this development, given its presence in this region of the country.

Finally, we think Cementos Moctezuma will likely see a small benefit from nearshoring thanks to its geographical footprint in the center of the country and its closeness to auto-part hubs in the southwest region of the country.

What does the company need to materialize this growth? Will they have to build a new plant or production line; or do they have unused production capacity?

In 2022, Cementos Moctezuma reported that their cement plants operated at an average capacity of 85%. This figure is similar to the average capacity reported by the industry of 84% between 2005 and 2015.

An operation capacity of 85% means that the company is currently producing around 6.8 million tonnes of cement annually. Based on this, in 2023 the company sold each ton at an average price of $2,891 pesos or $170 USD, at an exchange rate of US $1 per MX $17. When considering that the price per ton in the US in 2023 was $150 USD, a price of $170 USD appears a correct estimation.

In the short term, the company could increase its production capacity to 93% to meet an increase in demand. This would increase production to 7.44 million tonnes, and sales to MX $21,501 million. This represents an increase of 9.3% from 2023 revenue of MX $19,662 million.

Afterward, if there is unmet demand, the company can invest capital to expand production capacity through the development of an additional production line. Based on the investments of MX $1,332 million that the company made in 2015 and 2016 to increase production capacity by 1.6 million tonnes through the development of the second production line of the Azapan plant, we estimate that the company invested MX $832 for every additional ton of capacity–MX $1,231 today. Thus, an increase in production capacity of 1 million tonnes through the construction of a new production capacity would require the company to invest MX $1,231 million. This investment would increase the company’s production capacity by 12% and revenue by MX $2,687 million, assuming that the production line operates at 93% capacity. This revenue increase translates to MX $24,188 million in revenue or a growth of 12.5%.

The above growth could occur in the next 5 years, with the new government administration acting as a catalyst for the production of new homes, the start of operations of the Mayan Train and Corredor Interoceánico del Istmo, and the industrial developments from nearshoring.

If in year 5 revenue increases to $24,188 million and the company can maintain the average net profit margin achieved between 2016 and 2023 of 30%, then net income in 2028 would be $7,256 million–17% more than in 2023.

Earnings Power Value Valuation

I will first value the company through an earnings power valuation with no growth, where I capitalize the company’s normalized earnings (“sustainable earnings power”) at an appropriate rate to estimate its intrinsic value.

Revenue:

I believe it is too optimistic to use 2023 for normalized revenue considering that cement prices could decrease given the surplus in installed production capacity of the industry, and the high probability of Cementos Cruz Azul’s plant resuming operations in the short term. To remain conservative, I will take the average revenue from 2022 to 2023, this computes a normalized revenue of MX $17,972 million–8% less than the 2023 results.

Operating Margin: 40.8% (average between 2016 and 2023)

Tax Rate: 30% (corporate tax rate in Mexico)

NOPAT: MX $5,132 million (5,132 = 17,972 * 0.408 * 0.7)

Maintenance Capex:

D&A correctly reflects maintenance capex, so an additional reduction is not necessary.

Earnings Power: MX $5,132 million.

My estimate of normalized earnings compares positively to a net income of MX $4,386 million and MX $6,165 million achieved by the company in 2022 and 2023, respectively.

Discount Rate: 10%

I will use a discount rate of 10%, which represents my opportunity cost of investing in the company.

Earnings Power Value

Capitalizing the company’s earnings power of $5,132 million at an appropriate rate of 10%, I estimate that the intrinsic value of the company in enterprise terms is MX $51,320 million.

DCF Valuation

I will now value the company through a discounted cashflow valuation that incorporates future revenue growth in the next 5 years, and a conservative sales multiple in year 5.

My DCF valuations incorporate the following assumptions:

Revenue:

I will use the 2023 results as a starting point for revenue.

I will assume a 5% annual growth rate from year 1 to year 5, driven by an increase in demand for cement from the production of new homes, the development of the Mayan Train and Corredor Interoceánico del Istmo, and the economic development from nearshoring in the center of the country. I believe a 5% growth rate is a conservative estimation for the next 5 years, given the magnitude of the projects and developments highlighted above.

I estimate that to materialize this growth the company will need to increase production capacity to 93%, and then invest capital to increase production capacity by an additional 1 million tonnes.

FCFF as a % of Revenue: 30% (average between 2016 and 2023)

Maintenance Capex:

D&A correctly reflects maintenance capex, so an additional reduction is not necessary for the years where no investments to increase production capacity are made.

Growth Capex: MX$1,230 million + 30% (buffer) = MX$1,599 million

Capital investment to increase production capacity by 1 million tonnes, divided into two years, based on cost per additional ton from investments made in 2015 and 2016 to construct a second production line in the Azapan plant.

Discount Rate: 10%

I will use a discount rate of 10%, which represents my opportunity cost of investing in the company.

Sale Multiple: 12 times earnings

A multiple of 12 times earnings is conservative given future growth in demand for cement that will materialize from Mexico’s demography. Please note that because Cementos Moctezuma does not have debt and D&A correctly reflects maintenance capex, free cash flow in year 5 corresponds to the company’s sustainable earnings power that year.

My discounted cash flow to the firm valuation results in a value of MX $80,761 million for the company’s business.

Margin of Safety

At an equity market capitalization of MX $64,479 million and excess cash of MX $7,059 million, the market currently values Cementos Moctezuma’s operating business at MX $57,417 million.

I estimate that a conservative valuation for the company’s business to be MX $51,320 million, 10.6% less than what the market currently values the company at. This valuation does not incorporate future growth, and uses a revenue amount that is 8% lower than 2023 results. Although I believe this valuation to be a good starting point to understand the intrinsic value of the company, I think this value is too conservative because it translates into a multiple of 8 times earnings (2023 results). I believe it makes sense to incorporate growth in the demand of cement, based on Mexico’s demographic tailwind, a revamp of the housing sector, and the development of the Mayan Train and the Interoceanic Railway.

Based on the above, I value the company through a DCF valuation that assumes a conservative revenue growth rate of 5% for the next 5 years, and a sales multiple of 12 times sustainable earnings power at year 5. This produces an estimate of intrinsic value for the company’s business of MX $80,775 million, or 13 times earnings (2023 results). I believe that this valuation is a better representation of the intrinsic value of the company’s business since it takes into account future developments in a conservative matter. This valuation translates into an expected upside of 40% compared to the current enterprise market value, and a margin of safety of 28.8%.

Downside Protection

Cementos Moctezuma currently sells at 4.8 book value, this is a high multiple to pay and provides a low liquidation value of the company’s tangible assets relative to its market price.

At the current market price, the company’s net tangible assets provides us with little downside protection.

Conclusion

Cementos Moctezuma is a highly profitable business with significant amounts of excess cash. The company operates in an oligopolistic market with high barriers to entry due to the start-up costs of building a cement plant. The company holds competitive advantages in production scale and distribution, thanks to its access to raw material quarries at its plants, proximity to end markets, and use of railway as a transportation method.

The company has good management that runs the business for the benefit of shareholders. They return significant cash in the form of dividends and have prioritized profitability over expansion.

The demand for the company’s products (cement and concrete), will continue to be strong many years from now, thanks to the demographics of the population of Mexico, where 58% of people are below the age of 34, which will drive the demand of housing and infrastructure development.

The company sells at a high multiple of 4.8 times book value. Although this is appropriate, given the high returns that it is able to generate relative to its invested capital, between 2016 and 2023 ROIC averaged 59%, it does mean that the downside protection from an investment in the company, at the current price, is low, given the high multiple to net tangible assets that we are paying.

Valuing the company’s business using a discounted cash flow valuation with a 5% revenue growth estimate that considers the benefits of an increase in demand from a revamp of the housing sector, the Mayan Train as a transportation method, and the economic development of the southern region of the country, as well as a 10% discount rate that reflects my opportunity cost; I estimate the enterprise value of the company at MX $80,755 million or 13 times TTM earnings.

My estimate of intrinsic value offers a 40% upside vs the current market valuation of the company’s operating business of MX $57,417 million, and a 28.8% margin of safety.

Unfortunately, the current market price does not provide a sufficient margin of safety. Only when incorporating future earnings growth is the value of the company above market price, capitalizing normalized earnings at an appropriate rate of return results in an enterprise value of MX $51,320 million, this is below the company’s market price of MX $57,417 million.

Furthermore, a margin of safety of 28.8%, at a valuation that incorporates probable future growth, does not significantly protect us from negative scenarios, such as the entrance of new competitors, price regulations, an economic downturn, and price wars between competitors given the existing surplus in production capacity.

Finally, considering my estimate of intrinsic value vs the current market price, my potential upside is 40%, a figure that I do not find attractive enough relative to the risks. As mentioned before, the margin of safety is low, and the liquidation value of the company is not significant.

At the moment, I consider the company to be a great business, but the price is not low enough for me to consider this an attractive investment opportunity.

Sources & Data

https://docs.google.com/spreadsheets/d/1Qf5Ay2swxH5_3t2mt0Qot_Iakz1Y_NI1MrfaL5_pp0o/edit?usp=sharing

I have never heard of this stock and included it in my links posts for last week as I had only now seen your post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-july-8-2024

Its not owned by these funds who's holdings I looked at last year and will probably do an update for in August:

Mexico Closed End Fund Stock Picks (Early 2023)

Mexico stock picks or potential nearshoring stocks that are the holdings of Mexico closed-end funds Herzfeld Caribbean Basin Fund, Mexico Equity and Income Fund, and The Mexico Fund.

https://emergingmarketskeptic.substack.com/p/mexico-closed-end-fund-stock-picks-early-2023

Thanks for a great write up!