Consorcio Ara – Analysis and Valuation

A deep dive on a Mexican homebuilder selling significantly below its liquidation value.

30 minute read

Reason to Analyze Consorcio Ara

Consorcio Ara is unlevered, profitable, generates free cash flow to the firm, and has a diversified volume and revenue mix. Nevertheless, at current valuations the market is valuing the company at a multiple of 0.3x book value, placing a discount of 78% on current home inventory and valuing long-term inventory at zero.

Analysis Outline: How I Plan to Value Consorcio Ara

Company Overview

Introduction to the Homebuilding Industry in Mexico

Consorcio Ara

Assets Deconstruction

Why is the stock so cheap?

Management

Net Asset Value Valuation

Earnings Power Value

Margin of Safety and Downside Protection

Catalysts

Risks

Conclusion

Company Description

Consorcio Ara is a vertically integrated Mexican home builder that is family-owned and run. The company operates in 3 types of home segments–affordable, middle, and residential. The average price for affordable, middle, and residential homes is $40,000, $70,000, and $160,000, respectively. In 2022, 49% of homes sold were in the affordable category, 37% in the middle level, and 14% in the residential segment. In this same period, revenue from affordable, middle, and residential homes represented 33%, 38%, and 28%, respectively. In 2Q 2023, the company had a land bank of 30.7 million square meters – enough to build ~119,607 homes. In addition to home building, the company operates 6 different shopping centers–205,275 m2 of gross leasable area with an occupancy rate of 93%.

Market Valuation of Consorcio Ara

Share Price: $3.4

Equity Market Cap: $4,220 million

Cash: $3,114

Total Debt: $2,302

Net Debt: $-812

Enterprise Value: $3,408

EBITDA (TTM): $996

EV / EBITDA: 3.4

P/B: 0.28

Introduction to the Homebuilding Industry in Mexico

Mexican demographics – Demand for affordable housing in Mexico

Mexico’s population is around 126 million people today. Although population growth has slowed (Mexicans now on average have 2 children per couple), people today between 25-35 are the main drivers of demand for housing.

Mexico is a young country, 40% of Mexicans are 24 or younger and 58% of Mexicans are 34 or younger. This by itself explains why housing demand should remain strong for the foreseeable future. By 2030 it is estimated that there will be 34 million Mexicans aged between 20 and 39 years. Most of them will need homes.

Today Mexico has a 9.6 million housing deficit.

How is housing financed?

Housing in Mexico is primarily financed through government mortgage funds and commercial banks.

Government mortgage funds. This includes INFONAVIT for private sector employees; and FOVISSSTE, for government employees. These funds work by allowing workers to save a part of the employee’s paycheck in a special account called “subcuenta de vivienda”. This is money that the worker can’t access but keeps building up and compounds over the years. The funds then use the monies as down payment for the loan it extends and as a consequence the worker pays no money down on its new home.

Commercial banks mostly give financing for the acquisition of homes in the mid to high tiers.

Homebuilding in Mexico

Affordable home building is a very fragmented, competitive industry. There are 5 publicly traded home builders (Consorcio ARA, Javer, RUBA, Vinte, and Cadu) in Mexico. In total, these home builders sold 36,000 homes in 2022, compared to 136,000 total homes built by the industry.

Given the competitive nature of this industry and the limited available land in urban centers, land reserves are of utmost importance.

Some History - 2000s boom and 2014 crisis

In the 2000s, the president's Fox administration made it a priority to increase the number of homes built. He strengthened the INFONAVIT and FOVISSSTE to give more financing for affordable housing. These efforts attracted competition and overseas financing. The biggest competitors were: Consorcio Ara, Casas Geo, Homex, Urbi, and Sare.

By 2010, there was an oversupply of housing and many of the competing companies were over-leveraged. Most of these company’s land banks were of poor quality, and the method of reporting sales was skewed. The revenue from a home sale was reported when a customer made a down payment, not when the home was fully paid. This created large discrepancies between cash flow inflows and the P&L statements.

In 2013-14, president Peña Nieto’s administration made a dramatic shift to restrict the horizontal expansion of urban centers. The government stopped giving permits and subsidies for developments far out of city centers. This created difficulties for buyers to obtain mortgages, which slowed down the demand for affordable housing.

These changes crushed some Mexican home builders who had acquired low-quality land outside city centers and used it as collateral for debt financing. Casas Geo, Homex, Urbi, and Sare went bankrupt.

Homex was a particularly important case because it is considered to be one of the biggest financial frauds in Mexican history. Homex had a subsidiary called “Credito y Casa” that granted mortgage financing to its customers. Its loan book was junk, customers placed a $200 down payment and Homex recorded the sale of the home as full in their income statement. When Crédito y Casa and Homex defaulted, more than 100,000 homes recorded as sold in their P&L never completed.

Following the crisis, the market started experiencing a change in housing dynamics. Properties in the middle income to residential gained more relevance. A catalyst for this change was the government’s effort to support low-income families by offering a federal subsidy through the CONAVI, of which 2014 and 2015 were the highest in history. In 2015, $10.4 billion pesos in subsidies were given, compared to $1.3 billion in 2022.

Current Market Conditions

In 2018, AMLO’s administration significantly reduced the federal subsidy through the CONAVI. The government also imposed 8 new rules for people to obtain a mortgage loan from National Housing Agencies. An important one is the requirement for people to have a credit history. These changes have decreased available financing and the number of people eligible for a mortgage loan. The CEO of an important private home building company says that these changes have removed 7/10 of potential customers.

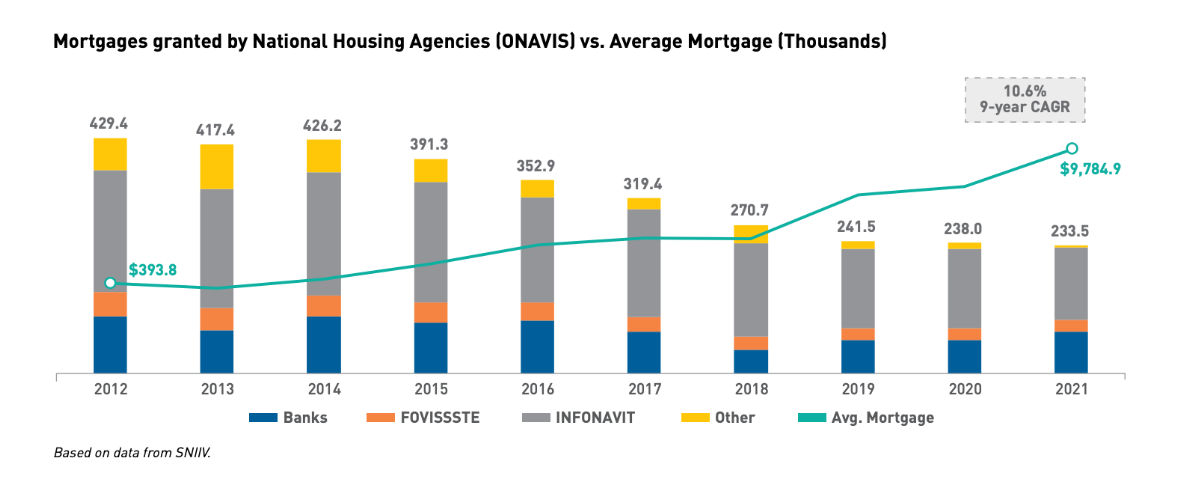

The following graph shows the production of homes per year. Mortgages granted by National Housing Agencies are at a decade low.

Today, home production and housing inventory are at a record low as well. Consorcio Ara, for example, sold 11,403 homes in 2018, compared to 6,293 in 2022.

According to the CEO of a private Mexcian home builder, the sector is going through a crisis. For the first time, ⅔ controlling entities of INFONAVIT are in agreement–labor and enterprise versus the political entity.

The market is seeing the effects of strong demand from the country’s demographics, rising costs of raw materials, and low available housing inventory and production. Since 2015, home prices have increased at twice the average rate of inflation. From 2018 to 2Q 2023, the price of affordable housing increased by 54% (Ara), 29% (Javer), and 72% (Cadu).

Average annual growth in National home prices from 2015 - March ‘23: 8.1%

Average annual inflation from 2015 - March ‘23: 4.7%

The lack of available financing for the acquisition of affordable homes has led home builders to shift and expand their operations in the mid to residential levels, which do not depend on government politics. The middle and residential segment will likely continue to have solid demand, as mortgage loan rates remain stable.

For a country with 126 million people of which 58% are younger than 34, current levels of production are unsustainable. Production is at a decade low, the country needs to build 500k houses per year and is only making 130,000. The housing deficit is rising, and eventually financing from National Mortage Agencies must increase, when this happens the industry will benefit. In the near term, home builders will likely experience slight increases in profitability from better pricing of homes, low available supply, and ongoing demand from Mexico's demographics. Long term, a rise in credit availability and the number of people eligible for mortgage loans will likely increase the number of homes produced, and as a result, the profitability of home builders because most of them have the capacity to build more homes than current levels.

Consorcio Ara

Understanding Cost Structure

The cost of revenue represents the costs associated with building the houses sold. These costs include urbanization, infrastructure, construction materials, and land.

Operating expenses mainly represent employee salaries, sales commissions, and advertising.

Construction is outsourced to construction companies that employ construction workers.

Although homes sold decreased from around 10k in 2019 to 6.2k in 2020, the company doubled its employee count from 2020 and 2021. Similar to a manufacturing company with unused production capacity, today, the company has the capacity to build more homes than at current levels.

Reinvestment Needs and Capital Intensiveness

Capital expenditures are not a significant expense for the company’s core business. In 2022, 2021, and 2021, the company invested a total of $60, $37, and $9.6 million pesos, respectively. These investments were in the areas of construction machinery, transport equipment, and office-related investments.

In the last 3 years, most of the company’s capex was related to the expansion and improvement of its commercial malls. In 2022, 2021, and 2021, the company invested a total of $172, $84.6, and $11.1 million pesos, respectively.

Non-cash working capital constitutes land, home inventory that is finished or in construction, and construction materials. Represents 54% of total assets.

Historically, working capital needs have been attributed to land purchases for new developments, financing of new developments, and payment of current debt.

Key Performance Indicators

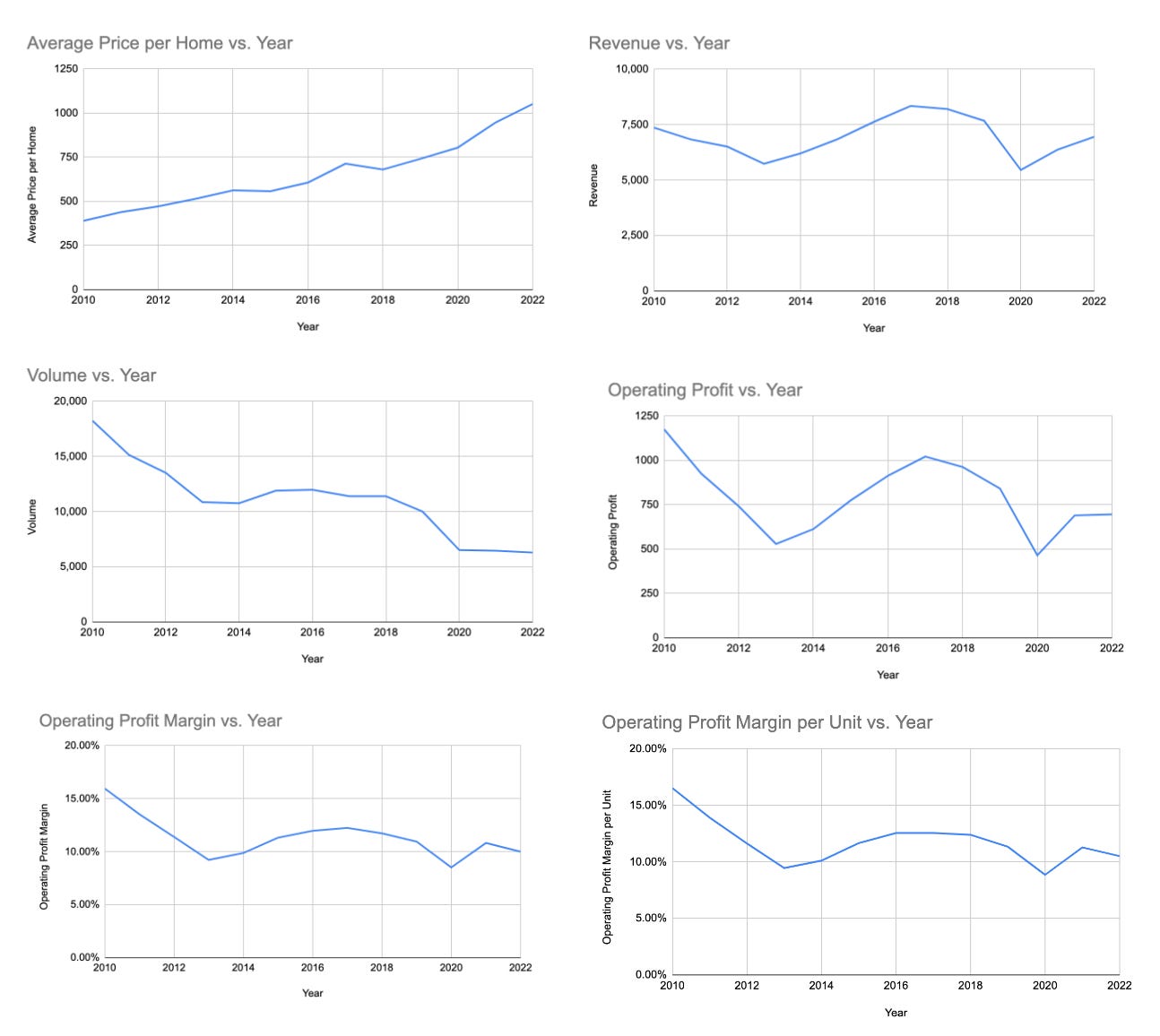

The volume of homes sold per year has decreased significantly in the past 4 years due to greater government restrictions on the availability of credit financing through government institutions. This decrease in volume has been offset by significant increases in the average price per house sold, which are a result of inflation, land appreciation, and a shift to selling more homes in the middle and residential segments.

We also observe how operating profit margin and operating profit margin per unit have decreased with less volume of homes sold. In 2018, operating margin was 11.7% vs 10.8% in 2022. The company is operating under capacity. It has the same operating expenses and overhead as when it built 11,400 homes in 2018 and is now only building around 6,200 homes. If Consorcio Ara can increase its production and maximize its capacity, then we can expect operating expenses as a percentage of revenue to decrease.

Ara vs Peers

Ara, Vinte, and Ruba have similar volume mixes, with a significant portion of units sold in the mid and residential tiers. Javer and Cadu focus on the affordable segments.

Ara and Ruba and Vinte revenue mixes are solidly diversified, with an even distribution between the affordable, middle, and high tiers.

Of all companies, Vinte is the least dependent on credit from National Agencies and the best protected against policy changes from the government. Ara’s operations are at risk of policy changes from the government, as 76% of sales come from financing from National Agencies.

Average industry EBITDA margin: 14.1%

With an operating margin of 7.4% vs 13.2% and 12.3% from competitors with similar mixes, Ara has lower gross and operating margins than its industry peers. As such, we should expect the company to sell at lower multiples to book value

.Although Ruba, Ara, and Vinte have similar volume mixes, Ara has the lowest operational efficiency. The average time it takes to sell inventory is significantly higher, almost twice as Vinte.

All home builders have experienced a significant increase in the average price of their homes sold. A sign of an under-supplied market vs the current levels of demand.

Management

Is management trustworthy?

I interviewed the CEO of an important private home builder in Mexico who personally knows German Ahumada Russek. He says that German is a very honest and highly trustworthy person. A very intelligent man, and one of the most balanced and prudent people in the industry.

Are management’s interests aligned with shareholders?

Together, German and his brother own 52% of the company’s shares outstanding. Management has the incentive to act in the interest of shareholders and create long-term value for the company.

Is management careful in expanding its land bank?

Consorcio Ara used to have a segment fully dedicated for the careful acquisition of land. The CEO of an important private home builder in Mexico with developments in Quintana Roo says that the company’s land bank in the state is well located.

German and his brother figured out that in their business there was hidden opportunity, the ability to develop commercial real estate near their developments and to then rent out and generate recurrent revenue. This segment greatly helped the company in the crisis of 2014.

Has the CFO / auditor changed recently?

The company’s CFO has not changed recently, she is Alicia Enriquez Pimentel, and has worked in the company since 2002.

Raúl Parra Sánchez is the current director of internal audit, this is his third year with the company. Previous to Raúl, the director of internal audit was Carlos López Pérez, he worked for the company for 20 years.

Assets Deconstruction

All figures in millions of pesos unless otherwise noted

Cash: $3,114

Customer Net Receivables: $658

Work in Progress Inventory: $10,812

Land: $1,308

Construction in progress: $9,504

Valuation method: Valued at cost

Audited: Audited by Deloitte

In 2022, 2021, and 2020, work in progress included 1,311, 1,752, and 1,656 finished homes. With an average cost per home of $815, finished homes represent $1,068 million pesos. Finished homes as a Percentage of inventory: 9.8%.

Long-term Construction Inventory: $2,073

Land Bank: $4,299

Land not included in work-in-progress inventory: $2,991

Size: 30.7 million m2, enough to build around 119,000 homes

Plots not related to housing: 2 million m2

Distribution of land bank by housing segment: 62% affordable segment, 29% middle segment, 9% high-income segment.

Valuation method: Valued at cost

Most of the land bank was acquired more than 10 years ago.

Fair Value Estimate:

According to GBM analysts and the company’s CEO, the company’s land bank holds some beachfront gems and is conservatively worth 1.4x its book value.

According to Aaron Edelheit (Mindset Value) and Javier Gayol (lead analyst for GBM), Ara has two stellar beachfront properties

Beachfront property in Baja California next to the new Four Seasons

Beachfront property in the Rivera Maya

Webinar with GBM and German Auhmada Russek (CEO of Consorcio Ara)

German mentions that a deal was in place to sell a plot of land in the Riviera Maya for $50 million USD. The buyer paid $10 million USD as a retainer but the deal did not go through. (minute 38)

German mentions that they also own another plot of land in ‘Los Cabos’ next to …. (minute 40)

https://gbm.com/academy/webcast/ara-la-empresa-mas-solida-de-mexico/

GBM’s analysts have visited the majority of ARA’s land bank throughout the years and done some research on key projects. After these visits, they found some plots that could be worth 10x their book value.

Shopping Centers and Strip Malls

The company has a commercial property division that generates a significant percentage of its free cash flow. It is composed of 6 shopping centers and strip malls. With an occupancy Rate of 93% and a total gross leasable area of 205,275 m2.

Book Value: $1,058

Book value of shopping centers and strip malls where the company has 100% ownership: $1,058

Book value of 50% stake in Centro las Américas: $155

Book value of 50% stake in Paseo Ventura: $139

Fair Value Estimate:

TTM NOI: $283.6 million pesos

Capitalization Rate: 10%

Fair value estimate: $2,836

Fair value of investment properties according to the company: $2,932

Other assets

Transportation equipment and Machinery: $172

Gulf Club shares: $173

How is the market currently valuing Consorcio Ara?

At current valuations, the market is discounting 78% of the value of working capital inventory (excluding land), valuing long-term construction inventory (excluding land) at 0, placing a 40% discount on other assets, and valuing the company’s land bank which was bought more than 10 years ago and investment properties at cost.

Why is the stock so cheap? Possibilities? What do analysts and management and competitors say?

List of possible hypotheses and their respective proofs:

The market is mispricing Consorcio Ara because investors have lost interest in the stock. Its market cap is around $200 million USD, with an average trading volume of $40,768 USD per day. The company is too small for institutional investors.

This could be true, however, a discount of 70% over the company’s book value due to the company’s size is unlikely. More than 40% of shares are floated and the company is followed by 6 analysts.

The company operates in a sector shunned by international investors from past experience in 2013 when 4 of the 5 biggest home builders in Mexico went bankrupt.

It is unlikely that Consorcio Ara is being mispriced because of a lack of interest from investors given the industry in which the company operates in. Vinte, Ara’s competitor with a similar volume mix, higher profitability, and higher efficiency, sells at 1.5x BV and a EV/EBITDA multiple of 13.

The company has off-balance sheet liabilities.

The company does not have off-balance sheet operations. The company does not have operations that are not correctly registered in its books in accordance with the IFRS. “Ni ARA, ni sus Subsidiarias o negocios conjuntos realizan operaciones que no sean debidamente registradas en sus libros conforme a las NIIF que les son aplicables.”

A high percentage of the company’s debt has its land bank as collateral.

The company does not have a high percentage of assets as collateral. The company only has a collateral of $221 million over its landbank.

The company trades at a discount because it does not generate free cash flow.

It is unlikely that the company trades at a discount because it does not generate free cash flow. The company has generated positive free cash flow to the firm for the past 9 years.

In the last twelve months, for example:

TTM NOPAT (including investment property): $533

Net Necessary investment in long-term assets: $0

Depreciation represents necessary capital expenditures correctly, thus an adjustment is not needed.

TTM Changes in noncash net working capital: $-43

FCFF: $576

The company has outstanding litigations.

We ran a search of past legal actions taken against the company and its subsidiaries and found none to pose a significant risk to the financial position of the company.

Our findings are coherent with management’s opinion, there are limitations outstanding as a normal course of business but they do not represent a risk for the financial or operating position of the company.

Operating risk from political policy changes in the number of mortgages given by INFONAVIT and FOVISSSTE?

Is it likely that Consorcio Ara trades at a discount to book value because 76% of revenue comes from customers who obtained their mortgage through a National Credit Agency. Making the company at risk of changes in government policies.

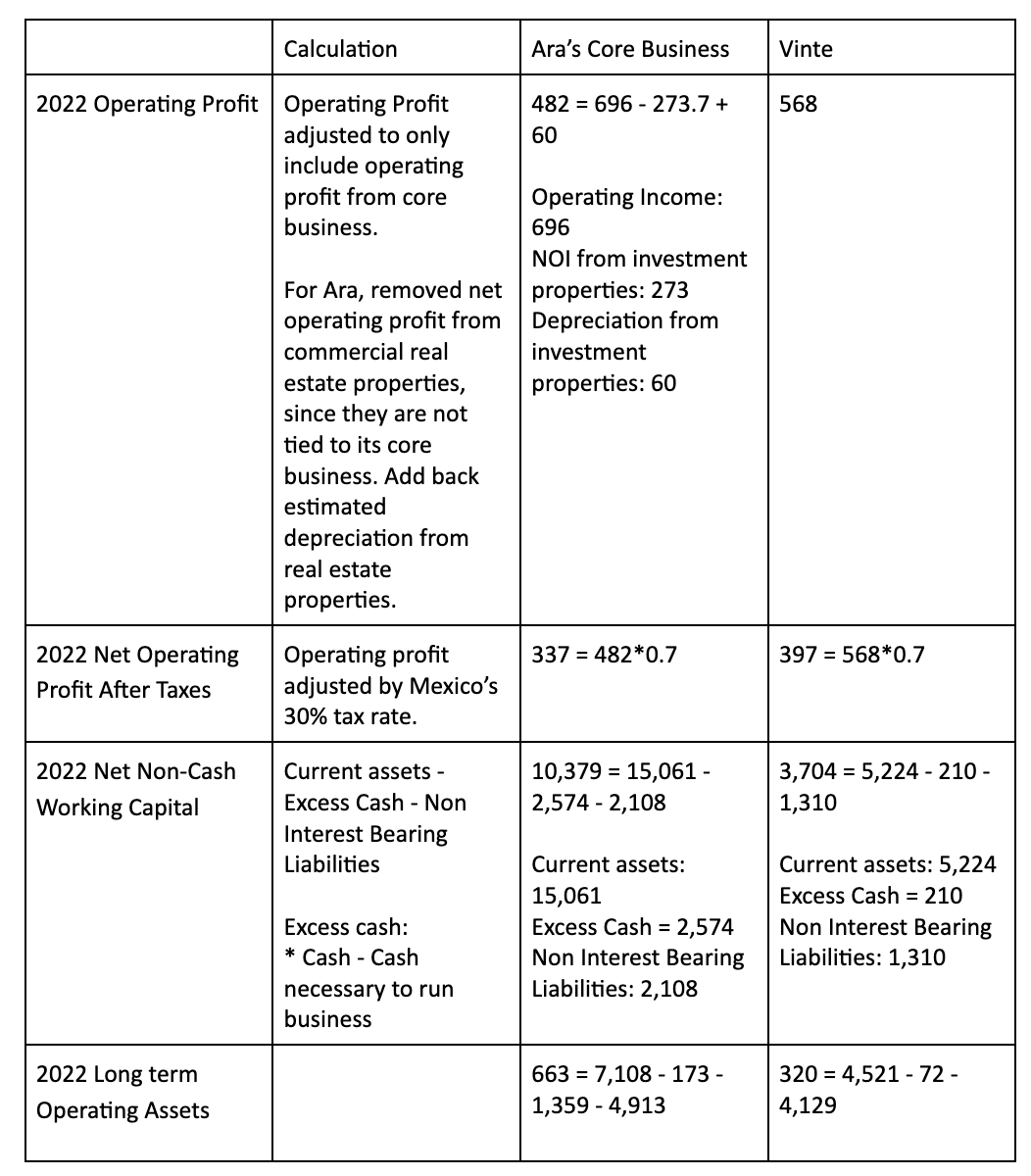

The company trades at a discount because it destroys value. Consorcio Ara has very low returns on invested capital, even if the land bank is worth more than what is said on the books when the company starts employing it in its core business, it will destroy value.

The market could be discounting the company’s book value because it earns very low returns on capital. The company is destroying value. In 2022, Consorcio Ara’s core home-building business generated a return on invested capital of 3%, compared to 9.8% for Vinte.

Break down of ROIC calculation:

We use NOPAT (Net Operating Profit After Taxes) as our numerator because, unlike earnings, it is the same whether a company is financed with all equity or if it has a lot of debt. Removing the issue of capital structure allows for effective comparison between businesses.

Invested capital, the denominator in our calculation, represents the assets that are necessarily employed by the business to generate operating profit. We calculate invested capital through an operating approach. In this calculation, we focus on Ara’s core home-building business and exclude net operating income from commercial real estate properties and the book value of those assets.

We begin with net working capital, a measure of liquidity that is defined as current assets minus non-interest-bearing current liabilities (NIBCLs). NIBCLs are basically all current liabilities that are not debt. Accounts receivables and inventories are generally the largest components of current assets. We subtract excess cash and marketable securities in your calculation of current assets, as these assets are not needed for the business to run.

Next, we add any other long-term operating assets. The key to estimating invested capital is to reflect all of the assets the company needs to run its business.

With a ROIC of 3% vs an opportunity cost of 11% (CETES 28) and invested capital of $11,042, each year the company destroys $883 million pesos = $11,042 * (0.11 - 0.03). This means the company is destroying 8% of its invested capital each year.

Consider this, imagine that Bob has $100 and his opportunity cost is 10%, if he invests the money but only generates a 3% return, then his money will be $103 vs the $110 he could have gotten. If Bob initially had $93 and invested it at his opportunity cost of 10%, he would end up with the same $103. Based on this, it is logical to value Bob’s $100 at $93 because he will destroy value by investing the money at a lower return than his opportunity cost. Applying this logic to Consorcio Ara, if the business invests $11,042 of capital but shareholders lose on the opportunity of earning an additional 8%. Then we can value the company’s invested capital for its core business at $10,224, implying an 8% discount.

This is a very important point. The company destroys value when it ties up capital in land, infrastructure, urbanization, and housing construction for many years. All that time that the capital was tied up, the company lost the opportunity to generate value. We can argue that the land appreciated through this time, however, as shareholders we would only see the value of this appreciation in the event of a liquidation. If the company continues to employ this land in its home building business which incurs high operation costs from normal operations, then the returns are very very poor.

It is therefore more useful to value the company in an ongoing manner and look at its liquidation value as our downside protection and margin of safety.

Net Asset Value Valuation

The following table shows the liquidation value of the company’s assets in different scenarios, an ultra-conservative scenario, a conservative scenario, and a base-case scenario.

* Landbank at 2.5 BV based on conservative multiple valuation estimates from CEO (2.5x) https://gbm.com/academy/webcast/ara-la-empresa-mas-solida-de-mexico/ (minute 40)

* Landbank at 1.7x BV based on collateral appraisal of 13 million m2 from bank in 2013

* Equity per share calculated by dividing implicit equity value by 1,229,662,178 shares outstanding

* Upside calculated as (Equity per Share / Equity Market Value per Share) - 1

* Does not include potential upside from beachfront gems in Riviera Maya and Los Cabos.

* Does not include other assets such as rights of use, and deferred taxes

Even though we observe tremendous upside potential when valuing the company through its liquidation value. As shareholders, we would only see this value in the event of a liquidation. The company is not likely to be liquidated soon. As such, I think it is more helpful to look at land values as our downside protection and value the company as ongoing through the cashflows that it is able to generate.

Dividend Discount Model

Recognizing that the company destroys value by reinvesting a large portion of its cash flows into its core business, I argue that the most logical approach to valuing Consorcio Ara is through a dividend-discounted cash flow model. This is because, even if a sizable chunk of free cash flow is generated from the commercial property segment, a good business, without a spin-off or sale of these assets accompanied by a special dividend issuance, we as shareholders will continuously witness value destruction.

Consequently, we believe that the only appropriate valuation method for the company rests on the dividends we anticipate receiving. These dividends represent the tangible cash flows returned to shareholders, assuming the company's core business remains operational.

We can estimate the value of these dividend payments by looking at the dividend yield from buying the company at the current equity market price; and through a dividend discount model valuation.

The dividend discount model valuation estimates the value of a company only based on the cashflows that the company will return to shareholders through dividend payments. Allowing you to value a company only based on the cashflows you will earn, irrespective of market conditions.

In 2019 the company increased the amount they can pay as dividends to 50% of net income.

On August 9 the company paid a dividend of $200 million pesos, a yield of 5% and 30% of net income in 2022.

Going forward, we expect the dividend payment to represent about 40% of net income. This means a dividend of $267 million pesos and a yield of 6.3%. This translates to a value of $2,427 based on a dividend discount model valuation, where we capitalize the expected dividend by an appropriate discount rate ($2,427 = 267 / 0.11).

Margin of Safety and Downside Protection

How the market is valuing Ara?

Share Price: 3.4

Equity Market Cap: $4,220 million

Cash: $3,114

Total Debt: $2,302

Net Debt: -812

Enterprise Value: $3,408

EBITDA (TTM): $996

EV / EBITDA: 3.4

P/B: 0.28

As mentioned before, at this valuation the market is placing a 78% discount on the company’s working capital inventory (excluding land), valuing long-term inventory at zero (excluding land), and both, valuing land that was bought more than 10 years ago and investment properties, at cost.

How does the current valuation compare with my estimate of intrinsic value?

The company is selling significantly below its liquidation value. Our ultra-conservative scenario discounts 20% of the work-in-progress inventory (excluding land) and values long-term construction inventory at zero. Furthermore, land banks and shopping centers are valued at cost, assets we think are worth much more. At this valuation, Consorcio Ara would trade at 0.65x book value. Even with these conservative assumptions, an investment in the company still provides an upside of 111% and a margin of safety of 53%.

With the above margin of safety, a lot of things can go wrong before we lose money. The working capital inventory of the company could be valued at a discount of 78% and we would still not lose money.

Conclusion

As an operational company, Consorcio Ara will perpetually destroy value by investing new capital at very low rates of returns. The company requires a lot of capital to be placed upfront and locked for a long period of time. And even after waiting and the land appreciating, the returns that the business is able to generate are very low compared to the company’s opportunity cost.

We can argue that the company is poised to benefit from changing market dynamics that will improve profitability. Home production and inventory levels are at a decade low, the country needs to build 500k houses per year and is only making 130,000. The housing deficit is rising, now at 9.5 million. Eventually financing from National Mortgage Agencies must increase, when this happens the industry will benefit from an increase of homes produced, and as a result, the profitability of Ara because today is operating under capacity. If this happens, then the business will be more profitable, but it will also have to invest more capital to build new homes.

I do not like the idea of holding a bad business for a long time, even if it benefits from changing market conditions, because returns on capital will likely go from really bad to mediocre. Home building is a business where there are no significant barriers to entry – capital requirements and scale can be replicated – and most cost-based efficiencies and technological advantages tend to be short-lived.

What we do see as very valuable is the potential catalyst for the company to sell excess real estate and return value to shareholders through a special dividend.

How likely is this? I do not know. We know that the company has beachfront properties of significant value. This provides us with a high but uncertain short-term upside and minimal downside of capital loss. The worst case is that we wait and nothing happens and are paid a 6.3% annual dividend yield.

We can not say at the moment if we favor investing in Consorcio Ara, for the time being, we present the analysis and will try to speak with management to get a better perspective on the probability of this catalyst occurring.

Resources

https://www.economia.gob.mx/datamexico

https://consorcioara.com.mx/financieros/reportes-anuales

https://www.vinte.com/es/reportes-trimestrales/

https://rubaresidencial.com/informacion-financiera/

https://ri.caduinmobiliaria.com/es/presentaciones

https://ri.javer.com.mx/en/trimestrales

https://www.bbvaresearch.com/wp-content/uploads/2022/11/SitInmobiliariaMexico_2S22.pdf

https://gbmenlinea.gbm.com.mx/Documentosanalisis/ARA_2022_Change_in_Estimates.pdf

https://gbm.com/academy/webcast/ara-la-empresa-mas-solida-de-mexico/

https://www.morganstanley.com/im/publication/insights/articles/article_returnoninvestedcapital.pdf