Cultiba – Analysis of Q2 2024 Results

A look at Cultiba's and Grupo Gepp's Q2 2024 results.

Introduction

In Nov 2023 when I first wrote about Cultiba, I mentioned Grupo Gepp’s growth strategy. Since 2019, the company has focused on increasing the average price per case it sells by increasing prices with inflation (nominal pricing power), and selling more bottled beverages as a percentage of cases sold. This strategy has allowed the company to profitably grow. Between 2019 and TTM 3Q 2023 the company grew EBITDA from $4,567 million to $7,890 million and operating margins increased from 4.98% to 8.77%.

In May 2024 I wrote a second article analyzing Cultiba’s 2023 annual results and the first quarter of 2024. Both periods showed very positive developments in the operations of Grupo Gepp, with growth in volume of cases sold, revenue, and margins–operating income in 2023 increased 18.58%.

However, although from an operating perspective Grupo Gepp reported very good results, its liquidity position did worry me. I believed the combination of high dividend payouts, increases in short-term debt, and the requirement to sustain capital expenditures put the company in a position of liquidity stress.

Since then, the company’s liquidity position has continued to worsen. In 2Q 2024 current debt levels increased significantly, to a level where I think it is important analyze and possibly re-evaluate my investment in Cultiba.

In this article I will analyze 2Q 2023 results to understand how Grupo Gepp’s deteriorating liquidity position impacts my valuation of Cultiba and investment thesis.

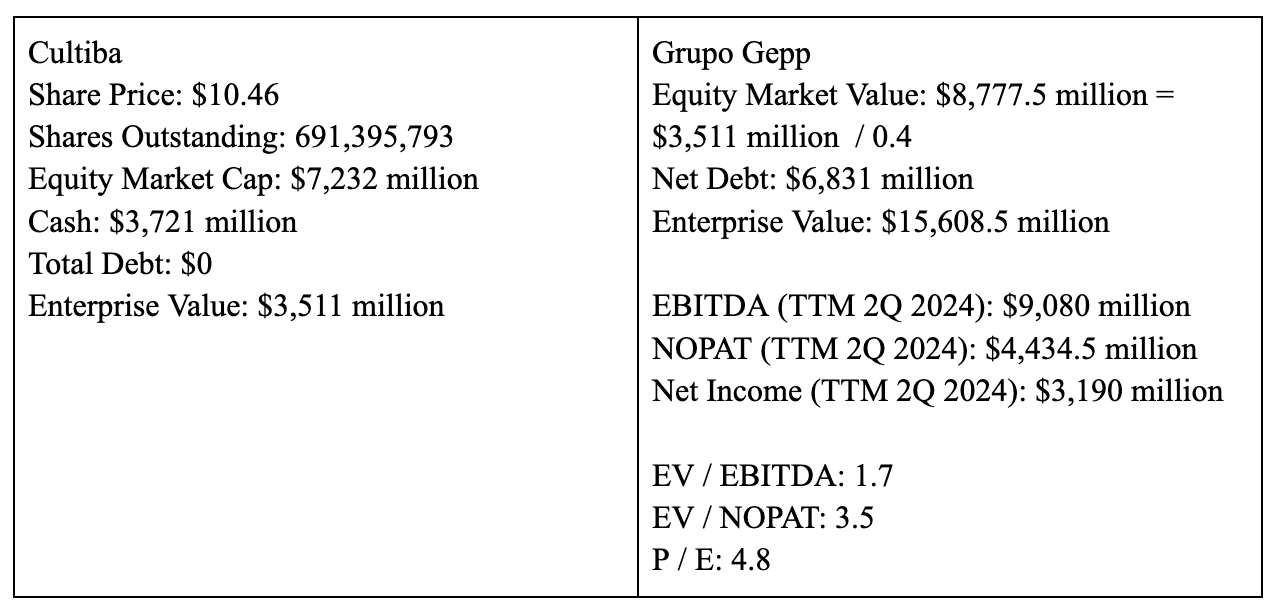

Market Valuation

It is worth mentioning how cash on hand now represents 48.5% of Cultiba’s market cap. This level of cash provides us with significant downside protection. Also, Grupo Gepp now sells at a more attractive price to earnings multiple than in my original write up, 4.8 vs 5.2.

Operating Results of Grupo Gepp

Grupo Gepp continues to benefit from price increases, a better sales volume mix, and higher sales volume. In 2Q 2024, sales volume benefited from higher than average temperatures in Mexico City. The company tends to sell more bottled beverages and jug water during periods of hot weather.

Revenue per unit case increased 5.1% year-over-year to $36.5. This compares positively with an increase in COGS per case of only 2.8% during the same period. Causing gross profit per unit case to increase 8.1% year-over-year.

It is important to highlight the trickle down effects that higher sales volume had on the company’s operating and net income. An increase in revenue of 12.8% YoY, translated into an increase in operating and net income of 25.7% and 23%, respectively.

Volume of Cases Sold: 516.8 million vs 481.4 million, a YoY increase of 3%.

Revenue: $18,877.5 million vs $16,735 million, a YoY increase of 12.8%.

Price per Case: $36.5 vs $34.72, a YoY increase of 5.1%.

Operating Margin: 11.3% vs 10.1%.

Operating Income: $2,125 million vs $1,690 million, a YoY increase of 25.7%.

Net Income: $1,152 million vs $937 million, a YoY increase of 23%.

Solvency of Grupo Gepp

Cash: $3,650 million

Short Term Debt: $8,000 million

Long Term Debt: $2,481 million

Total Debt: $10,481 million

Net Debt: $6,831 million

Total Debt / TTM EBITDA: 1.15x

The company is in a strong position to manage its total debt in the long term, indicating good overall financial health in terms of solvency.

Liquidity Position of Grupo Gepp

To evaluate the company’s liquidity position, I will consider both the company’s cash flow generation and cash on hand in relation to its short-term debt.

Operating Cash Flow in 2023: $5,502 million

Cash: $3,650 million

Short Term Debt: $8,000 million

Grupo Gepp’s maintenance capex is around $2,500 million. Using 2021 as reference, when capex was $1,494 million, I believe the company could temporarily decrease its Capex to $1,500 million. This leaves around $4,000 million of operating cash flow to pay short term debt. With $4,000 million and $3,650 million in cash, Grupo Gepp has almost enough funds to pay the total amount outstanding of short term debt. Most probable, Grupo Gepp is in a better liquidity position than stated in this example because the operating results have significantly improved. If operating cash flow increases 20% to $6,600 million, then the company would have enough funds to pay its short term debt.

Moreover, given Grupo Gepp’s stable business, strategic shareholders, and solvency position, it is likely that if needed, they can refinance short term debt or issue long term debt to improve their liquidity position.

Also, I believe it's very likely that shareholders of Grupo Gepp could make a capital injection to improve the company’s financial position. Cultiba holds a lot of cash, I do not think Juan Gallardo, the CEO from Cultiba and President of Grupo Gepp, would let the company go bankrupt.

Based on my analysis of Grupo Gepp’s overall financial health, I believe it will be able to solve its short-term liquidity problems through 1) the elimination of the dividend and temporarily decreasing Capex, 2) refinancing short term debt, 3) receiving a cash injection from shareholders. Considering these options I think the probability of bankruptcy is low.

Capex Grupo Gepp

Through the six months of 2024, the beverages division invested a total of Ps.1,668 million, compared to Ps.1,519 million in 2023.

Based on year to date figures, it is likely that Capex for 2024 will be in the range of $2,500 to $3,200 million.

Dividends Paid by Grupo Gepp to Cultiba

In Q2 2024 Grupo Gepp paid Cultiba $1,294 million in dividends. This represents a total payout from Grupo Gepp to shareholders of $3,235 million. An unsustainable amount given that it represents 101% of TTM net income.

Cultiba’s CEO, Juan Gallardo Thurlow, has significant influence over Grupo Gepp’s capital allocation decisions as the president of the board. I question his motive to pay these dividend payouts and build a large cash position in Cultiba. It would not surprise me if his objective is to take Cultiba private. If this happens then it's good news because the tender offer would be at around double the price of what the stock currently trades at.

Conclusion

Overall, given the continued improvements in Grupo Gepp’s operations, significant cash balance of Cultiba, and a lower share price, I believe an investment in Cultiba continues to be a great opportunity.

Moreover, a potential catalyst for value realization exists–Cultiba could go private.

Going forward, I think it is important to monitor Grupo Gepp’s financial position. I believe the company will solve its liquidity problems, however, deterioration could occur, and this would cause the risk profile and my investment thesis to change.

I linked to your post in my Monday emerging market links post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-september-16-2024

Not so familiar with them - this week I plan to do an updated post for this one I did last year: Mexico Closed End Fund Stock Picks (Early 2023) - Mexico stock picks or potential nearshoring stocks that are the holdings of Mexico closed-end funds Herzfeld Caribbean Basin Fund, Mexico Equity and Income Fund, and The Mexico Fund.

https://emergingmarketskeptic.substack.com/p/mexico-closed-end-fund-stock-picks-early-2023