Cultiba – Analysis and Valuation

Analysis and valuation of one of the owners of Grupo Gepp, the exclusive bottler of Pepsi Co in Mexico.

30 minute read

Updated on Feb 12 2023

Reason for investigation

Cultiba owns 40% of Grupo Gepp, the exclusive bottler of PepsiCo in Mexico, and the owner of Epura, Mexico’s third-largest bottled water brand. Grupo Gepp is profitable, earns high returns on invested capital, and leverages the pricing power of the brands it distributes to grow. Between 2019 and TTM 3Q 2023 the company grew EBITDA from $4,567 million to $7,890 million without requiring much additional capital. Between 2019 and 2022 invested capital only increased 9.8%.

Today only one analyst follows the company and the market is valuing the company’s stake in Grupo Gepp at $7,841 million, in enterprise terms. At this valuation, the company’s stake in Grupo Gepp sells at 2.5 times TTM EBITDA. This is cause for investigation, as competitors sell at multiples between 7-10 times TTM EBITDA and the company sold 11% of its stake in the company in 2016 in a private transaction at a multiple of 7.8x EBITDA.

Market Valuation of Cultiba

Company Description

Company Description

Cultiba is a Mexican holding company that owns 40% of Grupo Gepp. Grupo Gepp is one of the biggest beverage bottlers in Mexico and the exclusive bottler of Pepsico. It was founded in 2011 as a co-investment between Cultiba (40%), Polmex Holding (40%), and Pepsico (20%). Through its franchise agreement with PepsiCo, Grupo Gepp bottles and sells iconic brands such as Pepsi, Seven Up, Manzanita Sol, Mirinda, Be Light, Lipton, and Gatorade. The company also distributes brands from third parties like Cosecha Pura, Jarritos, Barrilitos, and Squirt. Finally, Grupo Gepp also owns Epura, the third most popular water brand in the country.

Recent Important Events

In 2011 Grupo Gepp was formed, combining Geusa, Pepsi Bottling Group, and Gatorade de Mexico to create the exclusive bottler of Pepsi Co with nationwide distribution coverage. Ownership of Grupo Gepp was distributed as 51% Cultiba, 20% Pepsi Bottling Group, and 29% Polmex.

In 2014, to combat rising obesity and diabetes, the government introduced a tax on sugary beverages. This negatively impacted gross margins because bottlers were unable to increase “real” prices that year, as the the beverage tax was passed to consumers.

In 2017 Cultiba sold 11% of its stake in Grupo Gepp to Polmex for EU $194 million, equivalent to $3,197 million pesos, at a valuation of $29,063 million or 7.8 times EBITDA.

In 2022, Cultiba spun off its sugar business due to low profitability and to focus on its beverage segment.

Industry History

The bottling industry was very fragmented during the early to mid-20th century.

Naturally, the industry consolidated, larger bottlers started acquiring smaller ones to achieve economies of scale in production and distribution. Larger operations could produce and distribute beverages more efficiently and at lower costs per unit. With scale, larger bottlers had the advantage of a more extensive distribution network. They could sell more volume and ensure their products reached remote areas, giving them a competitive edge. They could also negotiate better deals with suppliers due to their higher purchase volumes. Furthermore, large beverage companies like Coca-Cola and Pepsi preferred to work with bigger bottlers because of their capacity to produce in large volumes and distribute across vast territories. Over time, exclusive contracts and strategic alliances further marginalized smaller bottlers. Gradually, fewer and fewer smaller players were left, which led to the emergence of big Coca-Cola and PepsiCo bottling companies.

Coca-Cola and Pepsi Co. triumphed over other beverage brands thanks to greater advertising budgets, greater distribution, and greater production scale. Economies of scale allowed Coca-Cola and Pepsi to reach more customers, improve advertisement expenses per unit, and get their products at most consumption points (restaurants, convenience stores, movie theatres, hotels, etc).

Coca-Cola has historically dominated the Mexcian market. In 2002, PepsiCo had a 19% share of the soft drink market, while rival Coca-Cola Co had over a 70% share.

In 2011 there were only 3 main beverage bottlers in Mexico: Coca-Cola Femsa, Arca Continental, and Grupo Gepp.

Current Market Conditions

Today, the same bottlers that dominated the industry 10 years ago continue to do so. Grupo Gepp has a 27% market share in bottled beverages and a 57% market share in jug water.

According to Canadean, Mexico is the largest consumer of carbonated beverages at a per capita level, consuming 169 liters annually. The size of this market is immense. The total market size of carbonated beverages was EU$20 billion in 2022.

Through Gatorade, the company also competes in the isotonic beverage market. Mexico is the largest market for isotonic beverages in Latin America, with a market size of EU$1 billion. From 2017 to 2022 the compounded annual growth rate of this market was 6.5%

Also important is that Mexico is the largest market for bottled water in the world. Sales of jug water exceeded US$2.480 billion in 2022.

In the last 10 years, the consumption of soft drinks in Mexico decreased by 8.6%, while consumption of bottled water increased by 17%.

Grupo Gepp is in a good position to face the transition to healthier consumer preferences thanks to the company’s strong portfolio of isotonic beverages and water brands, which include Lipton, Gatorade, and Epura.

Analysis of Operations

Business

Grupo Gepp has two business segments, bottled beverages of 10 liters or less and jug water. Bottled beverages include soft drinks, isotonic beverages, juices, tea, and bottled water. Jug water is bottled water in presentations of 10 to 20 liters.

In 2022, sales of bottled beverages and jug water were $54,065 million, and the total volume of cases sold was 1,676 million. Bottled beverages represented 88.3% of sales and 58% of the volume of cases sold. Jug water represented 11.6% of sales and 42% of the volume of cases sold.

As for price per case, during 2022, the consolidated price per case was $32.6. The average price for bottled beverages was $49.6 vs $9 for jug water.

The following graph shows the company’s revenue per year.

Cyclicality

As the following graph shows, the company’s operations are not cyclical. The volume of cases sold has remained very consistent for the past 10 years. The volume of bottles beverages per point of sale only decreased -1.3% from 2017 to 2023.

Sales of bottled beverages benefit from wide availability in points of consumption, habit formation, association, and familiarity with brands. A lot of the Mexican population is accustomed to drinking soft drinks during meals and at special events. People associate soft drinks with happiness. Likewise, the price of soft drinks and isotonic beverages is similar to bottled water, as a result, many people prefer purchasing this instead.

As for the jug water segment, sales are recurring thanks to the company’s 1.2 million client portfolio. The company delivers jug water to its customers directly to their homes every week. This generates recurring revenue.

Pricing Power

Grupo Gepp can leverage the brands it distributes to increase the prices of its bottled beverages and pass inflation to consumers.

The following graph shows the price per case growth by category per year.

On the same note, the following graph compares the price per case growth for bottled beverages and jug water vs inflation per year.

We observe how the company can increase its prices to match inflation. We also observe how bottled beverages have stronger pricing power than jug water. The company has struggled to consistently raise prices of jug water. It is important to highlight the sharp increase in the price per case of jug water of 26.8% between 2018 and 2019–profitability benefited significantly thanks to higher revenue growth relative to costs and expenses.

Higher volumes of cases sold have not been the primary source for revenue growth. As we saw above, the volume of cases sold has remained relatively constant for the past 10 years, meanwhile, the price per case sold significantly grew.

Price increases and a higher percentage of sales from bottled beverages have driven revenue and price-per-case growth at a higher rate than inflation. This is evidenced by the following graph which shows revenue growth vs inflation per year.

Based on the above, we conclude that the company can increase its prices to meet inflation, and price increases plus a better product mix have been the primary source of revenue and price-per-case growth for the company.

Strategy to Increase Profitability

It is not a secret that selling bottled beverages is more profitable than selling jug water. Gross margins are higher thanks to greater pricing power, and operating expenses as a percentage of revenue are much lower. In the past years, the company has put effort into optimizing its product mix to sell more bottled beverages as a percentage of total volume. Management has successfully applied this strategy.

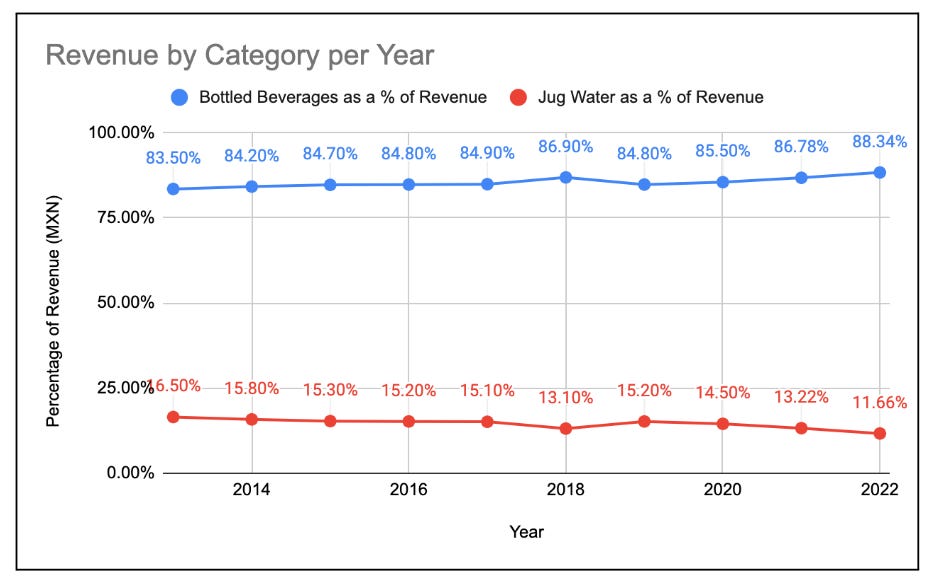

Bottled beverages as a percentage of sales increased from 84.8% in 2016 to 88.3% in 2022.

Similarly, bottled beverages as a percentage of total volume increased from 51.8% in 2016 to 58% in 2022.

A higher percentage of sales from bottled beverages and price increases have benefited the company’s profitability. We observe that between 2018 and 3Q TTM 2023 the company’s gross margin increased from 40.5% to 43.3%. Likewise, operating expenses as a percentage of revenue have significantly declined thanks to a higher percentage of sales from bottled beverages–decreasing from 39.5% in 2019 to 34.5% in TTM 3Q 2023.

Are Current Gross and Operating Margins Sustainable?

Big improvements in profitability naturally make us question their sustainability.

We argue that the current operating margin is sustainable because the company today has a better product mix than before and can increase its prices to meet inflation. If the company can maintain the current percentages of sales and volume of bottled beverages, then gross and operating margins should remain similar to today’s levels.

Nevertheless, to avoid being overly optimistic, we calculate sustainable operating margins by taking the average from 2019 to TTM 3Q 2023.

Average operating margin: 7.5%.

Competitive Advantages

Grupo Gepp has competitive advantages of scale and distribution. This is evidenced by the market dynamics, the returns on capital, and the operating leverage of industry players.

The bottling beverage market in Mexico is dominated by only 3 companies: Grupo Gepp, Arca Continental, and Coca-Cola Femsa. All players enjoy competitive advantages of scale and distribution, enjoy returns on capital of 18%-21%, and have operating leverage with suppliers.

These advantages act as great barriers to entry for new competitors and have helped consolidate the industry. Greater distribution allows for a higher volume of cases sold and more efficiency in advertisement spent. Likewise, a greater production scale allows for higher gross margins. Naturally, these advantages expand themselves by making these competitors the best bottling partners for big beverage brands. Grupo Gepp is the exclusive partner of Pepsi co in Mexico. Likewise, Coca-Cola has only 2 main bottling partners–Coca-Cola Femsa and Arca Continental. Competing without a franchise agreement from Coca-Cola or PepsiCo is not viable because sufficient scale is much more difficult to achieve.

We conclude that the competitive advantages of Grupo Gepp arise from its distribution and production scale, which are protected by the high barriers to entry of obtaining a franchise agreement with a beverage partner and investing the necessary capital to buy production facilities and set up a distribution network.

Business Durability

Competitive advantages of production and distribution scale plus an exclusive franchise agreement with Pepsi will continue to protect the company’s sales and returns.

The company operates in a non-cyclical industry where product demand is slowly changing. Consumer preferences towards healthier alternatives and government actions to make soft drinks less attractive to consumers are making soft drinks less desirable to consumers. In the last 10 years, consumption of soft drinks decreased by 8.6%, while consumption of bottled water increased by 17%.

Going forward, I expect a continued gradual decline in the per capita consumption of soft drinks and an increase in the consumption of bottled water and isotonic beverages. This does not mean that I expect the soft drink market to vanish. The brands that dominate today: Coca-Cola and PepsiCo, will very likely continue to do so. Moreover, the consumption of soft drinks will likely continue to be part of the Mexican diet, tradition, and culture for many years into the future. Thanks to the current popularity of consuming soft drinks at meals, social events, restaurants, and movie theaters. As well as the psychological factors that drive the current consumption of these drinks: familiarity with brands, habit formation, positive reinforcement, and association.

My expectation is for the decline of soft drinks to be offset by a rise in consumption of bottled water, isotonic beverages, and other drinks like tea and juices. Grupo Gepp is in a good position to face this transition. The company distributes Gatorade, and Lipton, and owns Epura, the third most popular water brand in the country. Furthermore, the company’s distribution network can be utilized to sell more products that align with evolving consumer tastes.

We conclude that even though the market is experiencing a change in consumer preferences towards healthier alternatives that are gradually decreasing the consumption of soft drinks; Grupo Gepp is in a good position to face this transition and has a big runway ahead thanks to the strong portfolio of brands it distributes and the scale of its distribution network.

Working Capital Management

Grupo Gepp is a great generator of cash, 65% of sales are paid upfront and 35% of sales are paid in credit.

Last reported results (2016)

In 2016, the ratio of non-cash current assets to non-interest-bearing liabilities was 1.1.

Days sales outstanding, which tells you how many days it takes for the company to collect receivables, was 44.5. Inventory days, which measure how many days it takes for the company to sell inventory, was 32.5. Days payable outstanding, which measures how long the company has to pay suppliers, was 66.5.

The cash cycle for the company is circular: suppliers -> inventory -> receivables -> cash ->

If we consider the above, then the cash conversion cycle, which measures the days it takes for tied-up capital in investments in inventory to be converted back to cash, was 11 days in 2016. We calculate this number by adding the days that cash is tied up in inventory and client receivables and subtracting days payable outstanding. We subtract days payable because it represents a time when cash is not tied up and the company gets financing from suppliers. The company only has to pay suppliers 66.5 days after receiving the inventory, which means that capital is tied up at day 66. If it takes 77 days to receive inventory and turn it into cash, then it means that only 11 days go by between when the company paid for inventory and received cash.

Current Situation

Since 2016, the company has expanded operating leverage and financing from suppliers. This means that the company has increased the days it has to pay its suppliers by increasing payables. This is evidenced by the changes in the ratio of Non-Cash Current Assets to Non-Interest Bearing Current Liabilities, which has decreased from 1.1 in 2016 to 0.6 in 2022.

Today the company is operating with negative non-cash working capital, and effectively financing its inventory with credit from suppliers.

In the case of the company, negative non-cash working capital is not a sign of distress. Rather, it is a sign of high bargaining power with suppliers, constant and non-cyclical sales, and the ability to increase prices with inflation.

Competitors operate similarly. In 2022 and 2021 Arca Continental had negative non-cash working capital, with the ratio of Non-Cash Current Assets to Non-Cash Current Liabilities at 0.85 and 0.82, respectively.

We conclude that improvements in working capital management together with a higher percentage of bottled beverages and price increases have helped the company increase return on invested capital. However, it is likely that the current operating leverage is unsustainable and will likely return to a level of between 0.7-0.8, closer to competitors and past results.

If supplier credit is reduced then the company would need to tie more capital in inventory and account receivables, which would increase invested capital. If we take 2019 as a sustainable level of operating leverage and a ratio of about 0.75. Then invested capital would increase by $3,281 million.

Is this a good business?

Grupo Gepp is a good business, this is evidenced by the company’s operations, operational leverage, and profitability. The company operates in a non-cyclical industry that allows it to sell a consistent volume of beverage cases. The company has competitive advantages of scale and distribution and has an exclusive franchise agreement with Pepsi Co. These advantages act as barriers to entry, protect the company’s returns on capital and sales volume, and allow it to have operational leverage with suppliers. Furthermore, the strong portfolio of brands that the company distributes gives it pricing power and the ability to pass on inflation to consumers. As a result, the company can grow revenue with inflation and maintain gross and operating margins. All this gives it a great runway for the future and sustainable operating margins.

In summary, the company is a good business because of:

Competitive advantages of scale and distribution

Exclusive franchise agreement with Pepsi Co in Mexico

Ability to leverage brands to increase prices with inflation

Noncyclical operations and consistent cashflow generation

High generator of cash

High operational leverage

Good return on capital (ROIC of 16.5% with a sustainable operating margin of 7.5%)

Financial Position

Since 2016 the company has increased its financial and operating leverage. In 2022, equity to total assets was 0.27 vs 0.57 in 2016. Shareholder’s equity has decreased from $15,093 in 2016 to $8,713 in 2022.

The rise in the company’s financial and operating leverage is a result of equity reimbursements as dividends to shareholders, an increase in net debt, and higher payables as a percentage of total assets. The latter is connected to improvements in working capital management, effectively increasing the number of days it has to pay back suppliers.

The following graphs display the company’s financial position. Outlying Debt / EBITDA per Year, Equity / Total Assets per Year, Net Debt per Year.

Is the company at risk of financial distress?

Given that the increase in leverage is mainly operational and that the company generates almost enough free cashflow to the firm to pay its net debt in a year, net operating profit after taxes in TTM 3Q 2023 was $3,711 vs current net debt of $4,816, I do not think that the company is at risk of bankruptcy.

In the event of financial difficulty, the company could issue long-term debt, use its cash on hand of $1,682 and cash flow from operations, to pay down short-term debt of $5,000 million.

Furthermore, I expect the company’s operational leverage to decrease as days payables to suppliers decrease and invested capital increases.

Management

Are management’s interests aligned with shareholders?

We think management's interests are aligned with shareholder’s because Cultiba’s CEO, Juan Ignacio Gallardo Thurlow, owns 66% of the company. Juan Ignacio is also the president of Grupo Gepp. In total, the main shareholders of Cultiba own about 70% of outstanding shares.

Is management someone we can trust?

Juan Ignacio Gallardo Thurlow is a very respected businessman in Mexico. A close source tells us that he has an excellent reputation and is a person of very high integrity.

Is management willing to return value to shareholders?

We think management is willing to return value to shareholders through stock buybacks and dividends. Since 2019 the company has returned a total of 2,288 million as dividends, equaled to a return of 28.6% compared to today’s equity market price. The company is also willing to repurchase up to $300 million worth of stock this year.

Dividends

2019: 1,022 million pesos

2020: $1,288 million pesos

Valuation

I will value Cultiba by adding its NAV plus the equity value of its 40% stake in Grupo Gepp. I will value the company’s stake in Grupo Gepp through a discounted cash flow model in enterprise terms. Then, I will subtract net debt from the enterprise value to find the intrinsic equity value of Grupo Gepp.

This approach allows us to estimate the value of Cultiba as if we were buying the business as a whole, getting the cash in the holding company plus the 40% stake in Grupo Gepp.

Cultiba

Equity Value = Cash + Airplane - All Liabilities

Cultiba’s NAV equals $2,771 million pesos = $2,579 million pesos + $228 million pesos - $36 million pesos.

The company’s cash position takes into account the capital used in the acquisition of Baja Acqua Farms.

Grupo Gepp - Discounted Cash Flow

Revenue TTM 3Q 2023: $60,445 million pesos

Sustainable Operating Margin: 7.5%

Tax rate: 30%

Net Reinvestment Needs: Adjustment is not needed because D&A reflects maintenance capex.

Changes in Non-Cash Working Capital: Invested capital increases by $3,281 million in 5 years as capital is tied up and operating leverage reaches a sustainable ratio of non-cash working capital to non-interest-bearing liabilities of 0.75. This means a reduction in free cash flow of $656 million per year, for the next 5 years.

Growth Rate: Revenue increases by 4% for the next 5 years; and 3% after year 5. We expect the company’s operations to continue to grow with inflation.

Discount rate: 11%, our opportunity cost for investing in the company.

Intrinsic value in enterprise terms: $40,181 million pesos

Intrinsic value in equity terms: $35,365 million pesos

EBITDA (TTM): $7,890

Net Income (TTM): $2,822

EV / EBITDA (TTM) multiple: 5.1

P / E (TTM) multiple: 12.5

We do not think these assumptions are overly optimistic, the company’s competitors sell at multiples of 8-10 times EBITDA and 15 times earnings.

Holding Company + Stake in Grupo Gepp

$16,917 = $2,771 + $35,365*0.4

Downside Protection

At the current equity market value, we can buy Cultiba for around $8,494 million pesos, get $2,771 million pesos, net of liabilities, and pay 5 times earnings for the company’s stake in Grupo Gepp. This is too low a price for a business that is not at risk of bankruptcy, has clear competitive advantages of distribution and production scale, and is the exclusive bottling partner of PepsiCo in Mexico.

Furthermore, this valuation provides us with a 49.8% margin of safety vs the intrinsic value of the company based on the cashflows that it can generate. And if profitability decreases significantly to 4.5%, due to fewer bottled beverages as a percentage of total volume sold or other setbacks, then the intrinsic value in equity terms of Cultiba would be $10,103 million pesos, still providing an upside of 19%, vs the current equity market price of $8,494 million pesos.

We conclude that at current prices, the company provides us with significant downside protection thanks to Cultiba’s cash on hand and the low multiple that the market is placing on Grupo Gepp’s business.

Risks

Unable to sell shares if we want to exit investment (this risk is currently reduced thanks to the company’s repurchase program of 300 million pesos)

Bad capital allocation from management. This is a real risk, management can destroy value through bad investments. Recently, the company acquired a stake in a tuna farm business, an industry that is not related to beverages.

Profitability decreases from fewer bottled beverages sold as a percentage of volume

Conclusion

We estimate that the intrinsic equity value of Cultiba is $16,917 million pesos. This calculation is based on the cash we can get from the holding company, net liabilities, plus the company’s 40% stake in Grupo Gepp. We estimate the value of Grupo Gepp through a discounted cashflow model that assumes a 7.5% operating margin, 11% discount rate, 4% growth from years 1-5, and a perpetual growth rate of 3%. At this valuation, Grupo Gepp would sell at 12.5 times TTM earnings and 5 times TTM EBITDA, this is an acceptable multiple considering that competitors sell at 15 times earnings and 8-10 times EBITDA.

Based on our estimate of the intrinsic value of Cultiba, an investment in the company provides an upside of 99%. The market is currently valuing the company at $8,494 million pesos–a multiple of 5.2 times earnings and 2.5 times EBITDA for the company’s stake in Grupo Gepp. This is too low a price for a business that is not at risk of bankruptcy, has clear competitive advantages of distribution and production scale, and is the exclusive bottling partner of PepsiCo in Mexico. Evidence of this is that in 2016 the company sold 11% of its stake in Grupo Gepp at an EV/EBITDA multiple of 7.8. The market is likely valuing the company incorrectly because only one analyst follows the company, shares are not liquid, and the company does not report the results of Grupo Gepp in its consolidated financial statements.

Furthermore, an investment in Cultiba provides us with a 49% margin of safety. If profitability were to decrease significantly to an operating margin of 4.5%, due to fewer bottled beverages as a percentage of total volume sold, then the intrinsic value in equity terms of Cultiba would be $10,103 million, still providing an upside of 19%.

Regarding liquidity, the company Cultiba has allocated up to $300 million pesos for share repurchases. If we want to exit our position, we can sell our shares to the company.

We conclude that Cultiba is a great opportunity due to the potential upside and low downside from Cultiba’s cash on hand and the low multiple that the market is placing on Grupo Gepp’s business. A business that is not at risk of bankruptcy, is not cyclical and has clear competitive advantages of production and distribution scale.