Direct vs Indirect Approach

A personal reflection on my plan to cultivate the ideal conditions to become a successful investor.

10 minute read

Direct vs Indirect

Last week I read an essay from Josh Tarasoff that made me re-think my plan to become a successful investor.

The essay talks about two different approaches for undergoing types of activities. Activities can be categorized into simple and complex.

Simple activities have a linear connection between inputs and outputs, where outputs are predictable. It is easy to understand what the expected output will be depending on the input.

With complex activities, the connection between inputs and outputs is non-linear, more complicated, and not fully understood. There is no set of actions that you can do to obtain a predicable result. Outcomes are unique and can vary a lot.

To illustrate the difference between these types of activities, Tarasoff compares assembling a lego tree vs growing a real tree:

Assembling a Lego set is a simple activity, while growing a tree is a complex activity. The Lego set is a straightforward matter, just add one piece after another, according to the instructions. On the other hand, the tree requires a different approach because its growth cannot be aimed at directly, such as by coaxing a seed to germinate or pulling on a sapling’s branches.

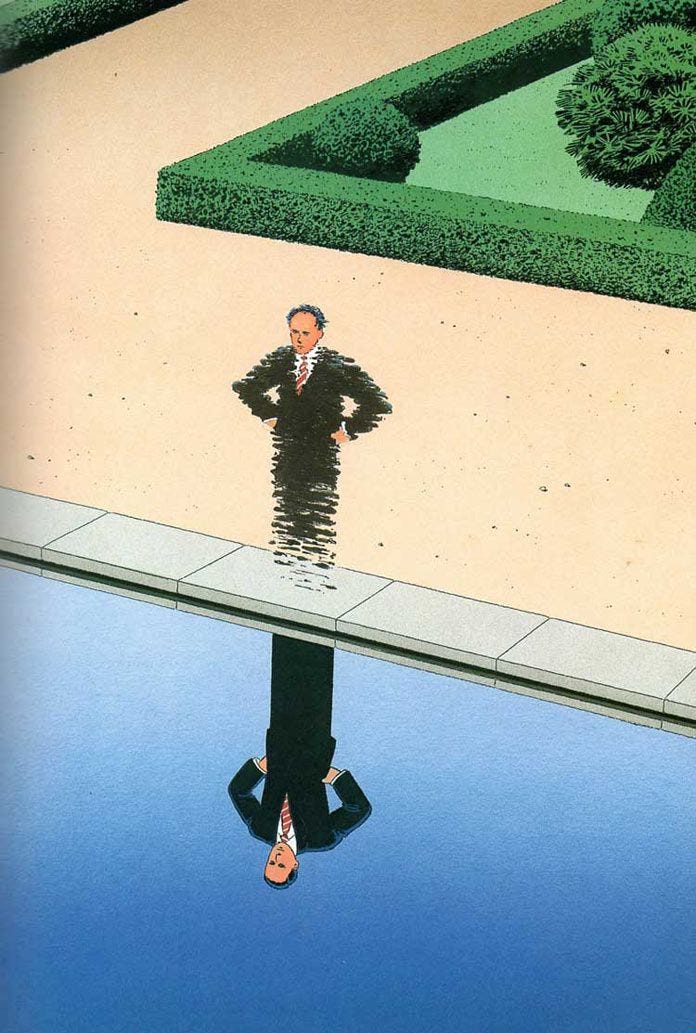

In Tarasoff’s example, building a lego tree requires a direct approach because of its straightforward nature. On the other hand, growing a real tree requires an indirect approach, in the sense that the right conditions must be set for the desired outcome to come about naturally.

“The seed should be properly planted in fertile soil, ample water and sunlight ensured, and so forth—such that over time the tree grows itself.”

Investing

Long-term investing can be thought of as a complex activity because the outcome is not proportional to the input. One cannot expect to get an investment idea after X hours of work. Rather, insights and ideas emerge naturally after continuous work under the right conditions. Thus, becoming a successful investor requires an indirect approach.

What might that look like to me? I have given a lot of though to this question, and realized that to successfully apply an indirect approach, one needs to really believe in what they are doing to have a high degree of patience and determination. With an indirect approach, it can take many years to reap the rewards, but long term I believe it is what will allow me to create a foundation that naturally results in me becoming a successful investor.

To me, I believe the following conditions make up the foundation which will allow me to become a successful investor:

Start from a foundation of studying the past and present of companies and industries that I find interesting, energizing, and promising—something pursued for its own sake, as a sort of default mode.

Do not knock on doors to raise outside capital. For a long period of time solely invest my own capital with the goal of compounding it at attractive rates with a generational time horizon. During these years, build up knowledge, experience, and operating capabilities within select circles of competences and create a foundational investment philosophy.

Create a business that produces free cash flow which can be redirected to my fund for intelligent capital allocation to allow me to take advantage of market opportunities.

Set up the correct structure of my fund/company from the beginning to allow me to have a long term investment view, not worry about short term volatility, and have an incentive scheme that promotes real returns for shareholders vs accumulation of assets to charge a management fee.

In regards to capital allocation, be a one man shop to have a lower cost structure and more time to dedicate to investment research because I do not have to raise continually more outside capital to earn a maintenance fee to pay for employee salaries.

Conclusion

You will notice that many of the conditions mentioned above mimic the structure that Buffett adopted for Berkshire Hathaway. His structure allowed him to be greedy when others were fearful, and think long term by not having the pressures of many institutional investors. In this sense, Buffett took an indirect approach, where continuous work under the right set of conditions naturally produced the success that Berkshire is today.