Médica del Sur – Analysis and Valuation

A deep dive on a single hospital operator with valuable real estate assets.

40 minute read

Preface

I originally wrote this analysis on December 8, 2024, which led me to invest in the company at a price of $32.8 pesos per share. Since then, the share price has increased significantly, validating my thesis. As of November 8, 2025, the stock trades at $55.8 pesos per share, representing a 70% gain.

I am publishing this article now to document my investment process for future reference.

Why is it worth analyzing Médica del Sur?

Medica del Sur is a single hospital operator in Mexico city that offers general and highly specialized clinical services. In the last twelve months the company generated $420 million net operating profit after tax.

Aside from its hospital operations, the company owns a 5 hectares plot of land next to its hospital complex. This real estate property was purchased in 2009 for $695 million and remains practically unused. Inflation adjusted, this property should be conservatively worth $1,110 million.

I believe the market is ignoring the value of this property. The company currently sells at $3,144 million, in equity terms, and is almost debt neutral, with $26 million in net debt. At this price, the company sells at 7.5 times normalized net operating profit after taxes, akin to earnings, given the company’s debt position.

The current valuation provides significant margin safety, factoring in the value of the company’s real estate property, we would be paying a multiple of 4.8 times earnings for the hospital business. This is very attractive, considering that a business with the growth prospects and competitive position of Medica del Sur should at least be worth 10 times earnings.

Market Valuation

Share Price: MX $32.84

Shares Outstanding: 95,739,768

Equity Market Cap: MX $3,144 million

Cash: MX $973.5 million

Total Debt: MX $999.5 million

EV: MX $3,170 million

TTM Normalized NOPAT: $420 million

TTM EV/NOPAT: 7.5

Business Overview

Business Understanding

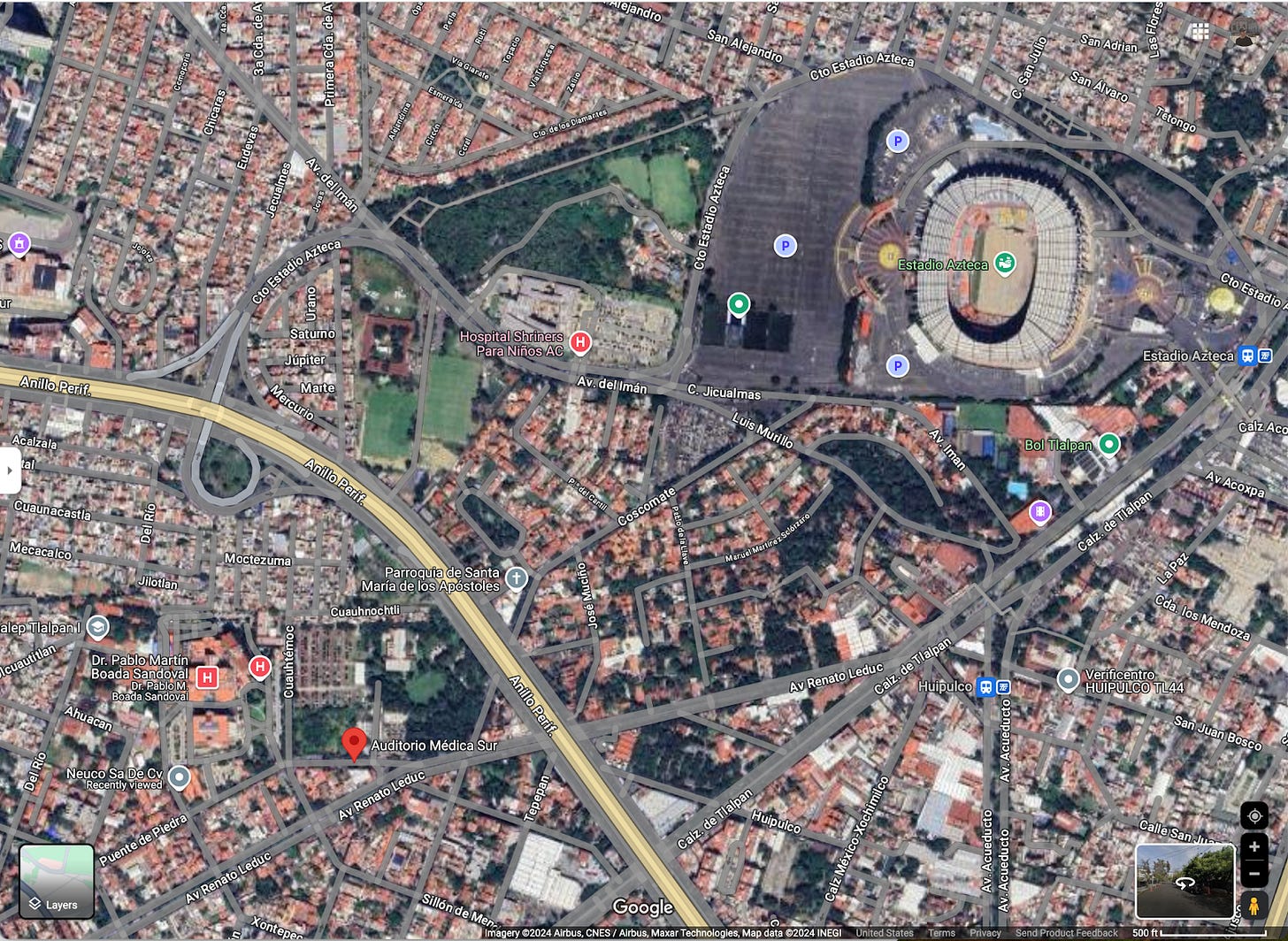

The company’s hospital complex has 189 beds and 20 surgical rooms and is located in the southern part of Mexico City in the Tlalpan district (within walking distance of Estadio Azteca).

General hospital services include basic surgeries, emergency care, maternity care, and routine inpatient stays. These services typically have higher patient volumes but tend to be more commoditized and less profitable than highly specialized clinical services because more hospitals can offer them.

Operating capacity of general hospital services is determined by the number of beds and surgical rooms available in the hospital. Think of this as the limiting factor driving hospital sales. As such, an important indicator for hospitals is the occupancy rate. The higher the number the better because fixed costs can be spread out more efficiently. The occupancy rate in 2023 was 68%, slightly higher than the average since 2014 of 66%.

As for highly specialized clinical services, this mainly include oncology, radiotherapy, radio surgery, gastroenterology, urology, imaging, and PET-CT.

Highly specialized clinical services are more profitable than general hospital services because few hospitals offer them, giving pricing and negotiating power to the few that do. A limited number of hospitals offer these services because they require significant capital investments in specialized equipment and facilities, creating natural barriers to entry. This scarcity gives these hospitals negotiating and pricing power with insurers. Hospitals can negotiate better reimbursement rates and charge more for these services.

In 2023, revenue from general hospital services and highly specialized clinical services represented 50.4% and 45% respectively.

The other 5% that makes up the company’s top line is rental income, and other minor activities like hotel operation and farmacy. The company’s hospital complex has 556 medical offices, of which 159 are leased. The rest were sold when the hospital was built. The complex also boasts 5 restaurants inside and 2 bank branches. In total, rental income in 2023 was $50.2 million.

Determinants

The main factors that drive hospital revenue for general and highly specialized services.

Doctors network

Relations with insurance companies

Available capacity, and utilization

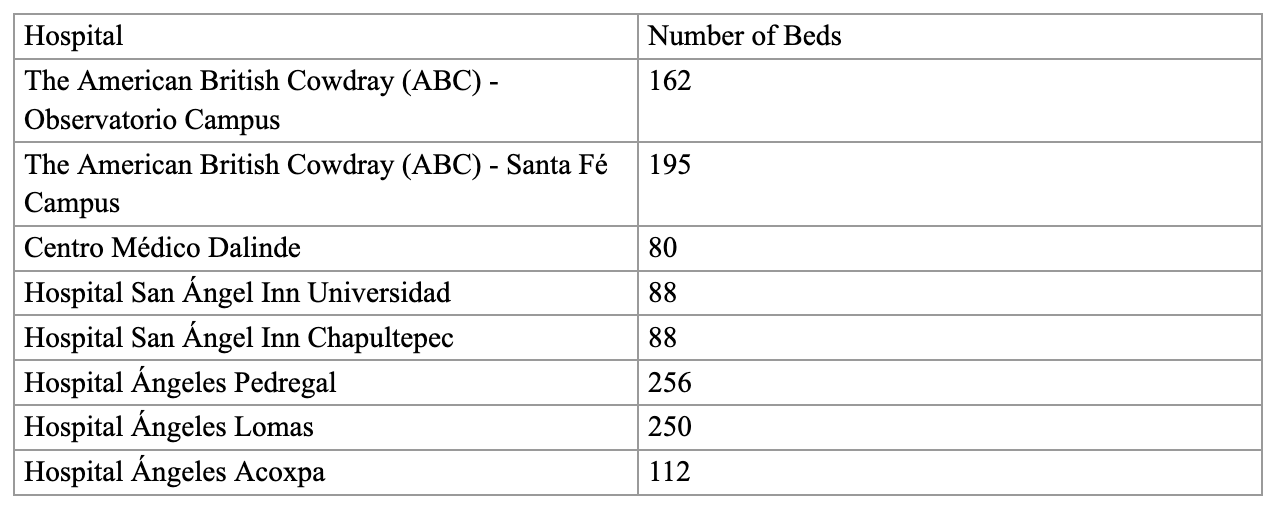

As mentioned before, available capacity is tied to the number of beds and surgical rooms that a hospital has. Medica del Sur is a large hospital relative to competitors, being one of the 5 largest hospitals in Mexico.

A hospital’s physician network is very important for patient volume. Doctors have private practices and refer patients to the hospital they are associated with. In this sense, doctors are an important distribution channel for the hospital.

Factors that drive the doctor’s hospital choice are: reputation, the quality of the doctors there, and available medical equipment. Medica del Sur has an association with more than 2,000 members. I expect that the company will maintain and continue to grow its physician network thanks to its reputation and highly specialized medical equipment.

Similarly, a hospital’s relationship with insurance providers is very important because they also refer patients. Being part of an insurer’s covered options results in more patient volume.

Barriers to Entry

The hospital industry has two main barriers to entry, which explains why we typically see existing hospitals expand capacity rather than new competitors entering the market.

In Mexico City, Médica del Sur competes with several large hospitals operated by just four hospital groups:

High upfront capital investment

Building a high-quality hospital requires investing large amounts of capital before receiving a single dollar.

Developers must:

Acquire suitable land (scarce and expensive in Mexico City),

Construct the hospital, and

Purchase specialized medical equipment.

Total investment typically ranges from $1,000–$2,000 million pesos, before a single patient is treated, making the economics prohibitive for new entrants.

Physician network development

Hospitals rely on independent physicians who bring their patient base with them. New hospitals must convince these doctors to switch from their current affiliations—an uphill battle given that established hospitals already provide infrastructure, prestige, and referral volume. Physicians are scarce, so attracting them away from an existing ecosystem is difficult.

Payer Mix

The company mostly has two types of customers: privately insured and out of pocket patients. Privately insured patients represent 2/3 of sales, and out of pocket patients represent 1/3.

Billing & Payment Collection

To fully understand the financials of the company, it is important to consider how they bill and collect payments.

Large hospitals in the private sector do not employ medical specialists and only in-house physicians for emergency care and diagnostic services. Most physicians are self-employed and are allowed to practice in the hospital by being part of the hospital’s network.

Doctors receive payment for their professional services through what’s called “professional fees.”. Accounting wise, these payments are considered direct costs and show up in cost of sales of Médica del Sur. The flow of operations works like this:

Hospital bills insurance for both professional and facility fees

Hospital collects total payment

Hospital pays physicians their portion

Shows up as higher revenue and higher costs (pass-through) on hospital financials

Shareholders

Neuco SAPI de CV is the majority holder, owning 57% of outstanding shares.

31.4% are owned by public investors

In 2017 ProActive Capita, a private equity fund led by Jose Antonio Fernandez Carbajal, chairman of FEMSA, announced a 40% purchase of Neuco, thereby controlling 20% of Medica Sur shares.

Miseal Uribe Esquivel and wife are the other majority owners of Neuco. Misael is currently the chairman of the board.

Overall there is limited information available of other owners of Neuco beyond the ones mentioned above.

Health Industry in Mexico

Industry Overview

The Mexican health system consists of three main components operating in parallel:

Employment based social insurance (IMSS)

Public assistance services for the uninsured

Private sector which includes hospitals, insurers, and pharmaceutical and medical device manufacturers and distributors

Choice between public and private medical providers is mostly associated with the patient’s economic class. People with more money generally prefer private providers because public health providers are seen as untrustworthy.

83% of Mexican households situated in socioeconomic strata E (extremely poor) to C (below the poverty line) opt for services at low cost in consulting rooms adjacent to the pharmacies.

The more advantaged households (in socioeconomic strata C+ to A, making up 17% of households) opt for private providers and are served by 15,500 independent specialist physicians mostly through self-referral. Specialists are increasingly located in consultation clinics adjacent to the country’s 94 largest private hospitals, which serve as their primary source of referrals for high-technology analyses and admissions.

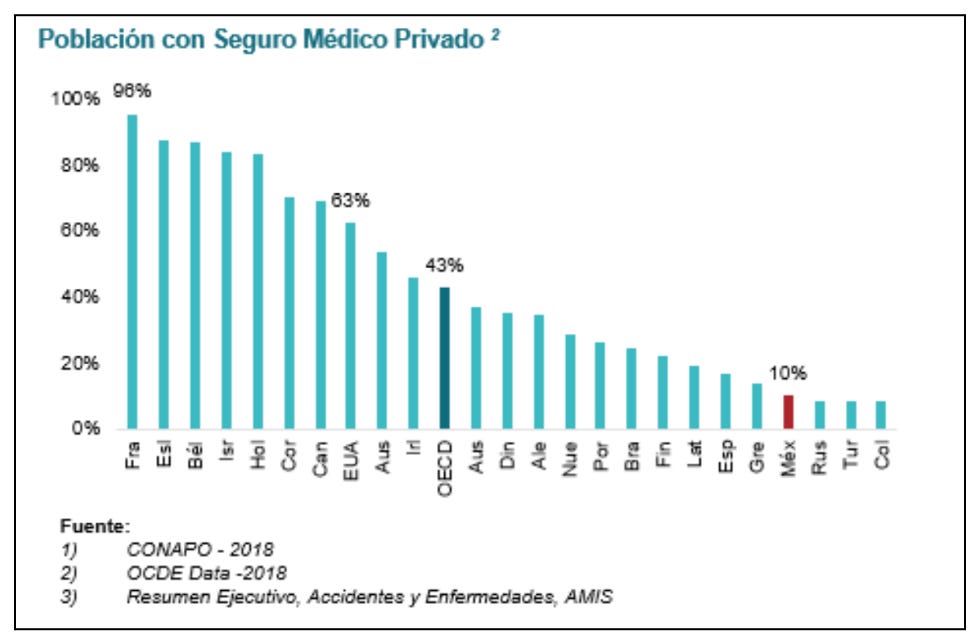

27% of the population in strata C+ to A are privately insured, mostly through policies reimbursing hospital expenses.

Health Spending

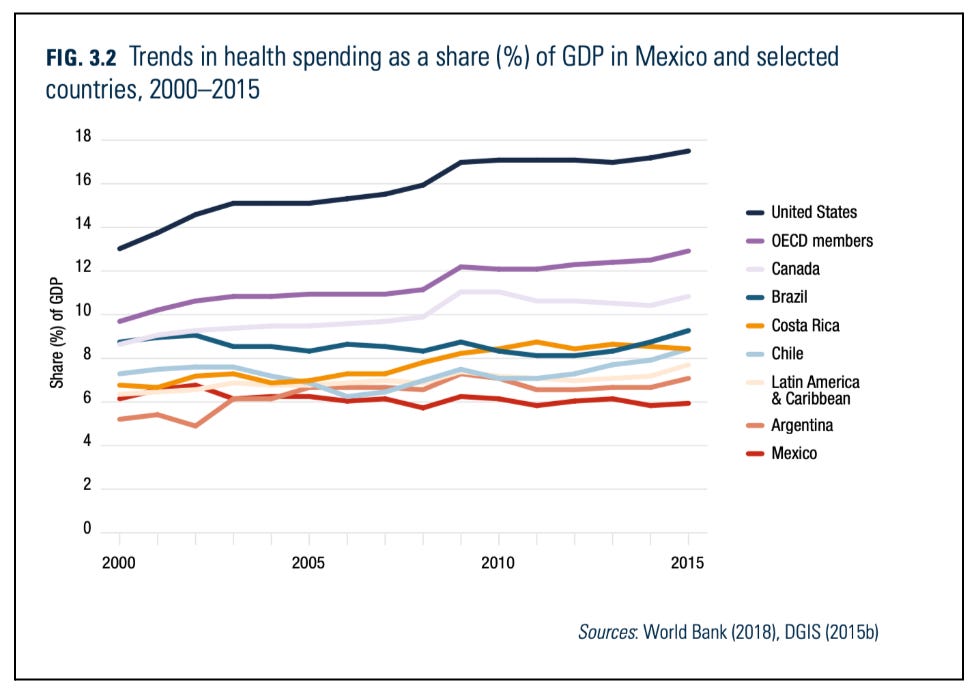

Mexico has consistently had the lowest level of health spending as a proportion of GDP in the group of countries with similar or higher levels of development in the Americas, such as Argentina, Brazil, Canada, Chile, Costa Rica and the USA.

In 2023 health spending as a percentage of GDP was 5.3%, vs an average of 8.8% for OECD countries.

Insurance Market

The insurance market is highly concentrated. 27 private insurance companies offer health insurance in Mexico, but 57% of policies is concentrated in three companies. GNP as the leader with 24.5% market share, followed by AXA with 17.5%, and Metlife with 16.5% market share respectively.

In 208, only 10% of the population had private medical insurance, up from 7.8% in 2015. This figure has constantly increased since 2000 as more people have entered working age.

Demographics

Mexico’s demographic profile creates unique and attractive market dynamics for private healthcare:

Population Size & Composition

Population Size: 132 million people

Gender distribution: 52% women, 48% men

Median age: 29.6 years.

Youth concentration: 57% of the population is under 34 years old.

Working-age pipeline: A large segment of the population will transition into working age.

Aging Shift

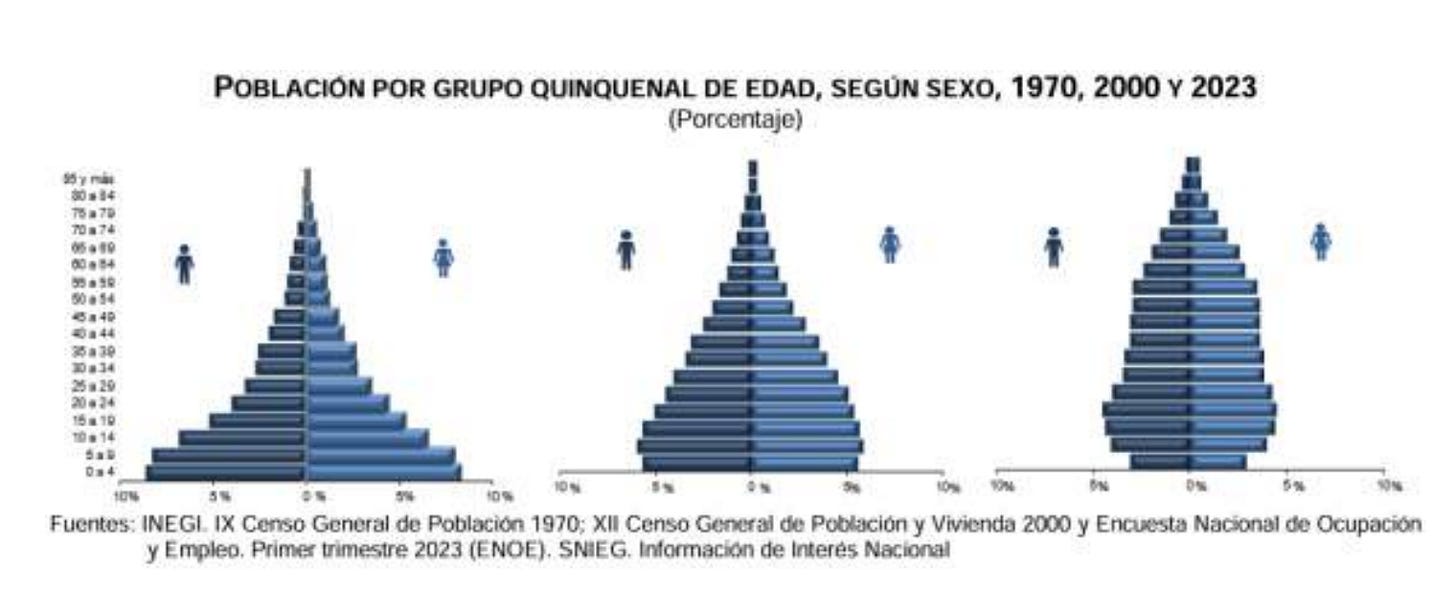

Since the 1970s life expectancy has increased and fertility has decreased, contributing to a shift in the population pyramid to a more mature distribution.

By 2030, 30.5 million Mexicans will be age 60+, representing 22.2% of the total population. This means Mexico is beginning a demographic transition similar to developed economies, though still at an earlier stage.

Insurance Penetration Link

In Mexico, private health insurance is tied to formal employment.

As more individuals enter the workforce (and formal economy), insurance penetration rises.

When individuals have insurance, utilization of private hospital services increases materially, driving higher patient volume for hospital operators.

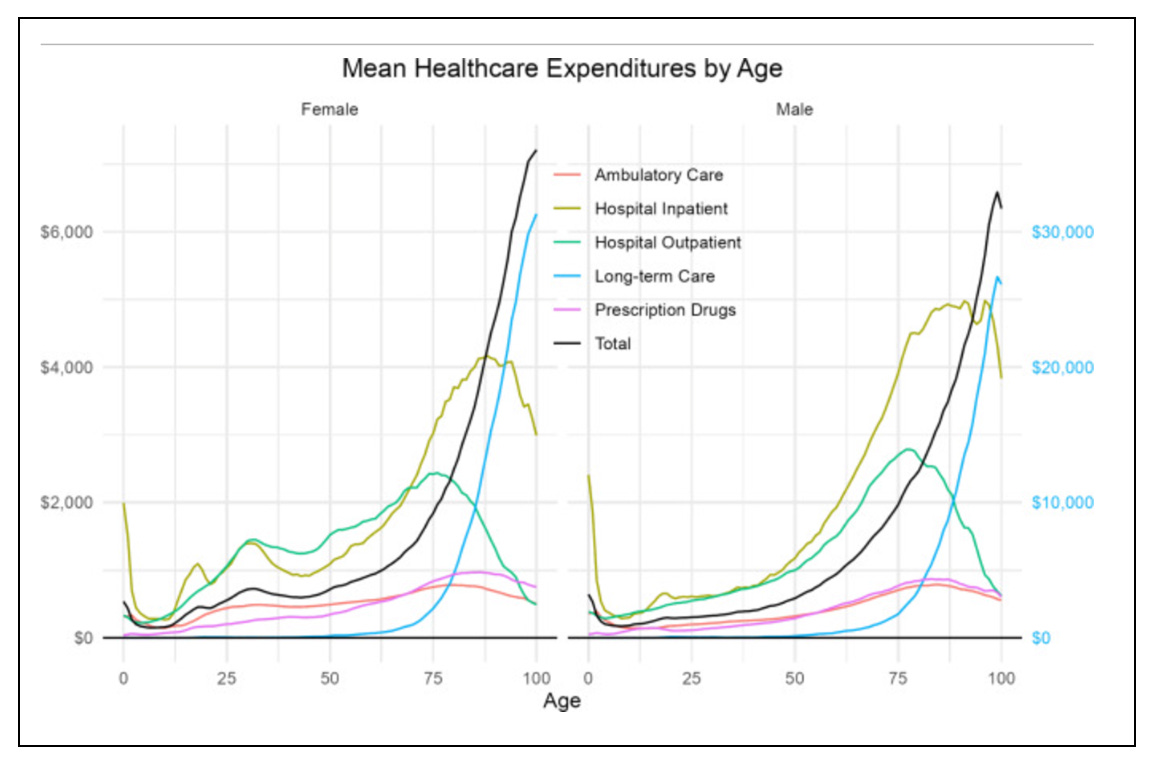

Healthcare Spending and Age

Healthcare spending tends to increases exponentially with age. Expenditures rise sharply after age 55, driven by hospital inpatient specialty services, long term care, and prescription drugs.

Implications for Médica del Sur

The combination of a young working-age pipeline and a rapidly growing elderly population creates a rare double tailwind that will increase patient volume and demand for speciality services.

More people entering working age → more private insurance coverage → more hospital visits.

More elderly patients → higher medical consumption → greater demand for specialty services.

For a large specialty-oriented hospital like Médica del Sur, this translates into:

Higher patient volume, driven by increased insurance adoption.

Higher specialty services, as aging population requires more complex procedures

Being one of the largest hospitals in Mexico with a focused on specialty services, Médica del Sur is well positioned to benefit from this expected demand.

Analysis of Operations

Background Information

The company has undergone several significant events over the past decade that help explain its current strategic position, and management’s alignment with shareholders.

From 2014 to 2021, the company directed most of its capital allocation to the laboratory services segment (e.g., blood testing). In 2016, it acquired Laboratorios Médico Polanco for $1,492 million. Management successfully capitalized on the surge in demand for COVID testing, and in 2021 sold the laboratory business to Synlab Group for a base price of $2,250 million, plus an additional variable royalty component. The company received royalty payments of $100 million, $500 million, and $77 million in 2021, 2022, and 2023, respectively, and the final royalty payment of $39 million in 2024.

Proceeds from the sale were returned to shareholders. In 2022, the company paid a special dividend of $26.83 per share, totaling $3,019 million, and repurchased $206 million of stock, reducing fully diluted shares outstanding by 4.5%.

In 2023, the company sold a non-core real estate property for USD $12.5 million. This property previously operated as Hospital Clinic but was closed in 2017 due to low occupancy. With these proceeds, the company paid another special dividend of $6.53 per share and repurchased $429 million worth of stock, reducing shares outstanding by 10%.

Since 2019, the company has repurchased 22% of its outstanding shares. Fully diluted shares outstanding currently total 95,739,768, down from 123,281,750. The company reports 107,938,972 shares outstanding, of which 12,199,204 are held as treasury stock.

Normalized Operations

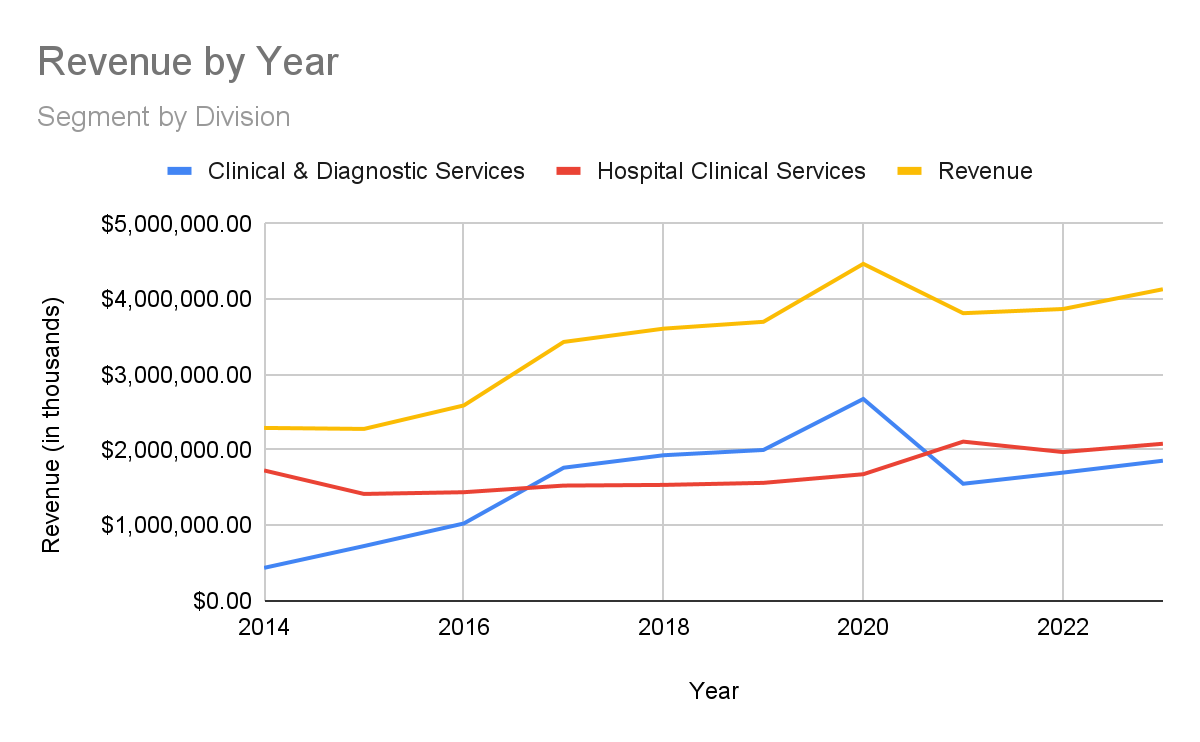

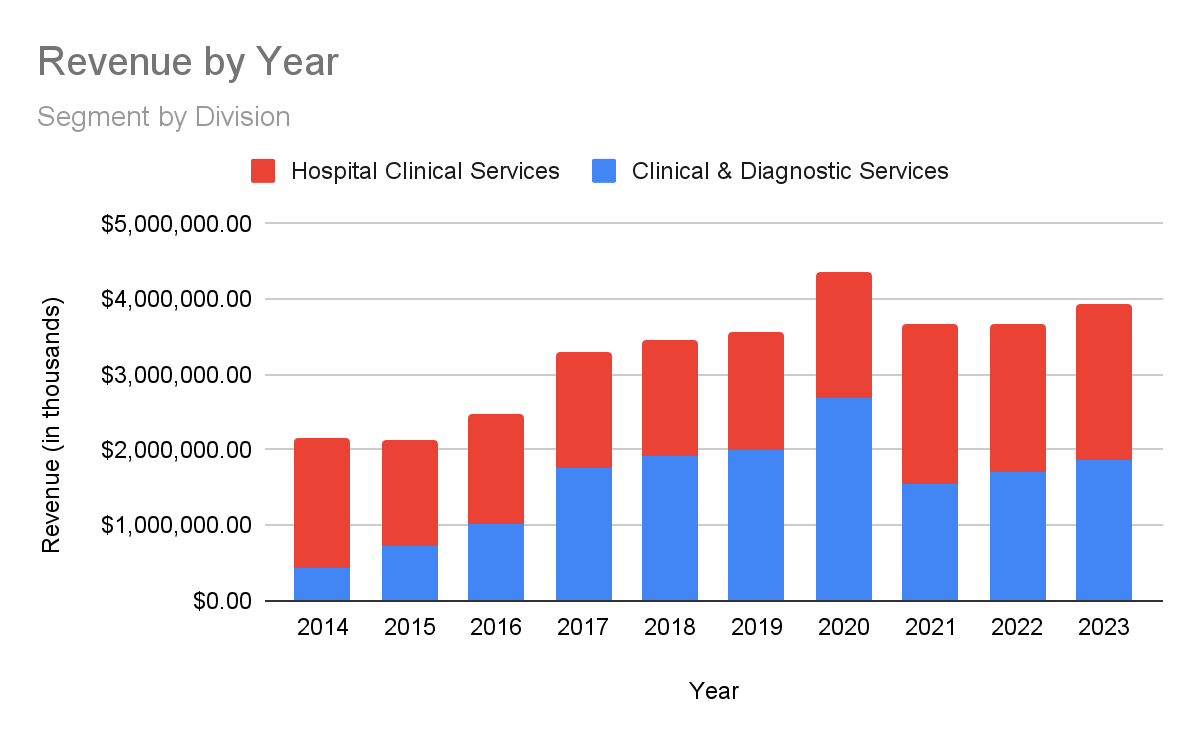

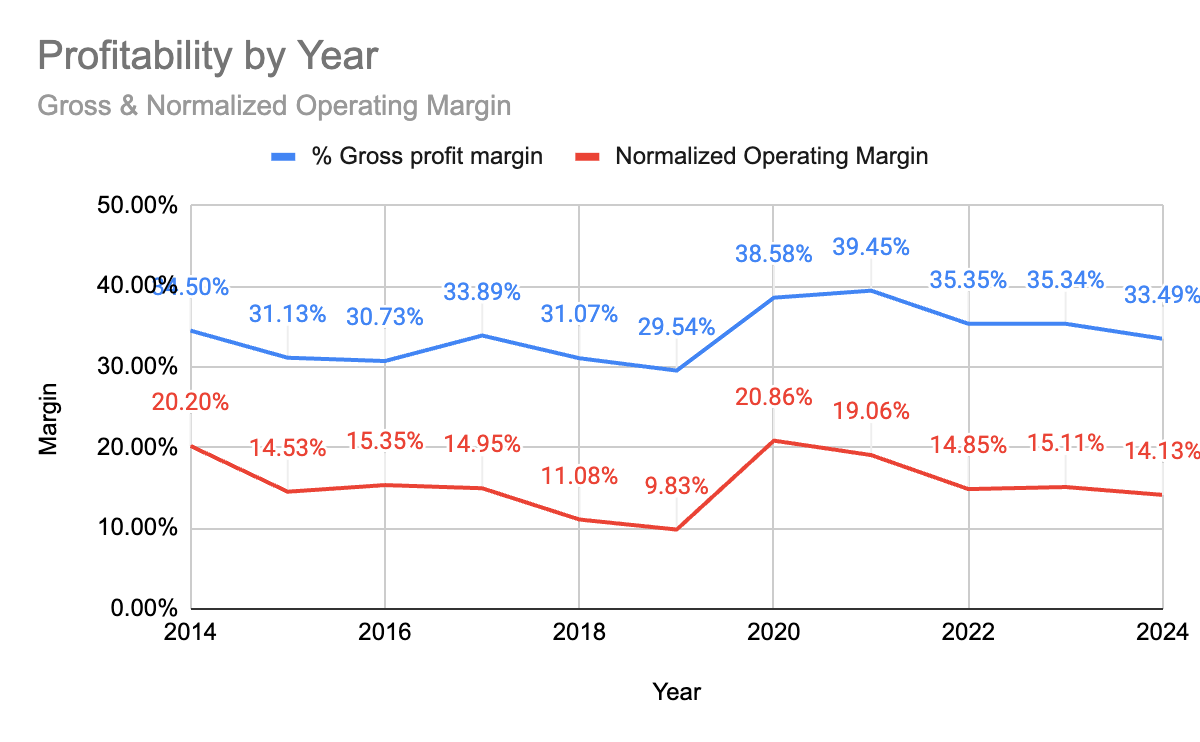

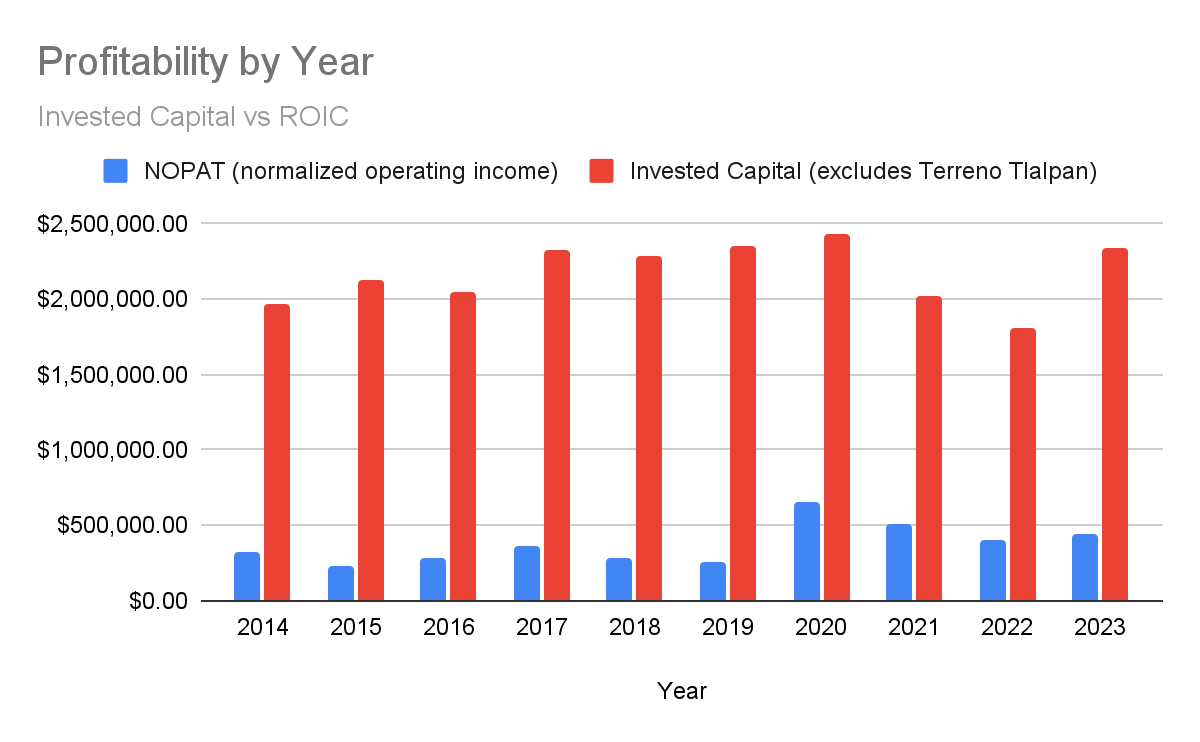

The following graphs display the company’s normalized operations, excluding extraordinary expenses, net gains from asset sales, and non-recurring income from royalties from Synlab.

Revenue from the clinical and diagnostic services division grew from $437 million in 2014 to $2,676 million in 2020. This growth was primarily driven by:

The opening of new lab branches,

The acquisition of Laboratorios Médico Polanco in 2016, and

Exceptional demand for COVID-19 testing.

After the sale of the laboratory business in 2021, revenue from clinical and diagnostic services declined 42%. Since then, revenue has stabilized, supported by highly specialized medical services.

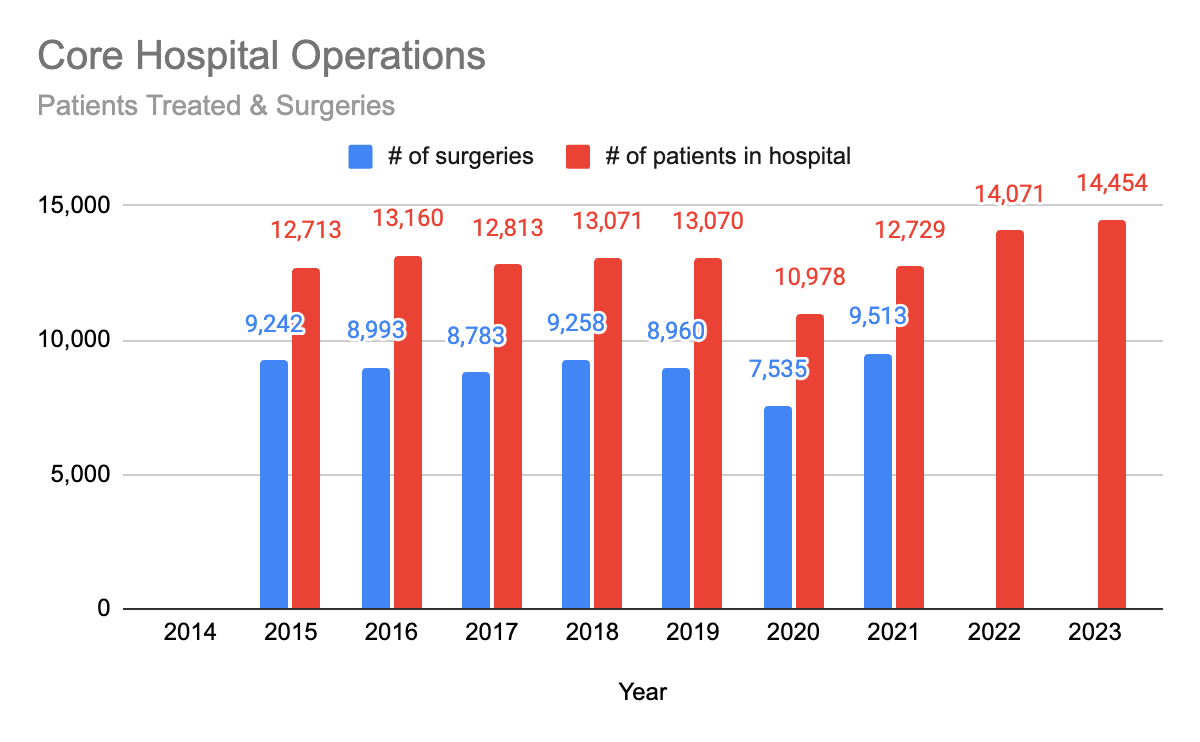

General hospital clinical services performance has remained relatively stable over time. During the pandemic, demand shifted toward higher-ticket, complex procedures, which reduced the number of hospitalized patients and surgeries but increased revenue. More recently, the company has strengthened its relationships with insurance providers, resulting in higher patient volumes.

Overall, the company’s operations have now normalized.

I think going forward margins should look like the average of 2023 and 2024, which are very similar to pre-pandemic margins when diagnostic services from lab operations represented a smaller portion of revenue.

The company’s strategy to focus on its highly specialized medical services and core hospital operations should also stabilize margins going forward. The following graph illustrates the company’s gross and operating margins by year from 2014 to 2023.

Profitability

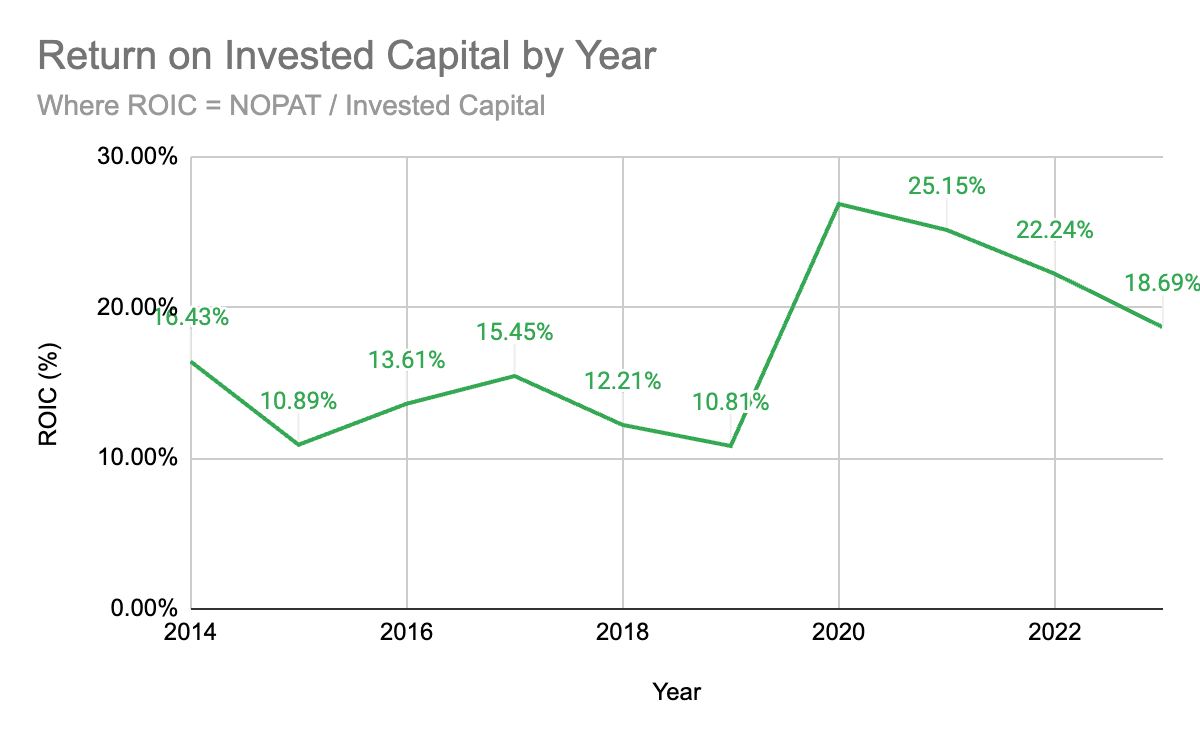

Return on invested capital has a positive correlation to occupancy rates. A higher figure indicates that the hospital can better spread out its fixed costs and have lower operating expenses as a percentage of revenue.

Between 2020 and 2022 profitability benefited from COVID, mainly from higher sales from lab tests which improved operating income.

Compared to pre-pandemic levels, more recent figures show higher profitability mainly from higher patient volume and higher occupancy rates, which has contributed to higher revenue.

Valuation

Hospital Business

Considering the hospital’s business growth prospects from an aging population and rising levels of insurance penetration, plus the barriers to entry that protect the company’s business, a multiple of 10 to 12 times earnings is reasonable. Taking the company’s $420 million net operating profit after taxes, which I think is a good proxy for earnings because the company is debt neutral, the business is worth between $4,200 million and $5,040 million.

Real Estate Properties

As previously mentioned, the company owns valuable unused real estate. In 2009 they acquired a 50,000 square meter plot of land adjacent to the hospital complex. This property is within walking distance of Estadio Azteca. The company refers to this property as “Terreno Tlalpan”.

In 2014 the book value of “Terreno Tlalpan” was MXN $695 million. Adjusted for inflation this land is now worth around MXN $1,100 million. Moreover, in 2021 the company received an appraisal for this property of MXN $3,061 million. I think a midpoint between these values is a reasonable estimate for what the property is worth, the mid-point being $2,080 million.

Apart from “Terreno Tlalpan”, the company also owns a real estate property that they call “CEDISEM”. Currently they use this property as office and teaching space but the company is actively looking to sell it. In 2019 they received a buy offer of USD$5 million, but the deal fell through when Covid-19 hit. I expect this property to be worth around MXN $100 million.

In total, I think a reasonable value for these real estate properties that are not needed to carry out the current business is between the range of MXN $1,200 million and MXN $2,180 million.

Valuation

The following sensitivity table shows the possible ranges of value for the company, considering different earnings multiples and overall real estate values.

From this analysis, we find that the company is worth between $4,560M and $7,220M, in enterprise terms.

At the base case of 10 times earnings, the value of the company is around $6,000 million, considering a midpoint in the valuation of real estate.

It is important to note that my most optimistic case scenario is not out of reach, given the reasonable multiple compared to expected growth, and that the value of Terreno Tlalpan is ⅔ of what the company says its worth.

Conclusion

Compared to the current enterprise value of $3,170 million for the company. Our most conservative scenario provides an upside of 44%, and margin of safety of 30%. Our best case scenario provides an upside of 127% and a margin of safety of 56%.

The company’s real estate assets provide really good downside protection against unexpected circumstances. If we deduct $1,200 million worth of real estate from the enterprise value (taking the lower end of our RE valuation), the earnings multiple drops to 4.7.

Considering the upside potential of 127% and the downside protection from real estate assets, I think an investment in the company is a really good opportunity.

Que buen análisis!