Megacable – Analysis and Valuation

A deep dive on a Mexican telecom company.

30 minute read

Reason to Analyze Megacable

Megacable is a profitable, unlevered, high-quality business that is trading at under 3.9X EV/EBITDA.

The company generates significant cash flow through its recurring revenue subscription model.

Free cash flow is likely to increase from the conclusion of the development of its GPON Evolution project. The company invested significant resources to build and transition 40% of its subscriber base to a fiber network (FTTH).

Earnings are posed to increase because current figures incorporate 6-month promotional rates offered to stimulate the growth of the subscriber base in newly served municipalities, which will roll off with time as new markets mature.

Analysis Outline

Company Description

Introduction to the Telecom Industry in Mexico

Analysis of Megacable’s Business

Main Assets

Analysis of CAPEX Initiatives and Maintenance Capex

Profitability

Conclusion

Company Description

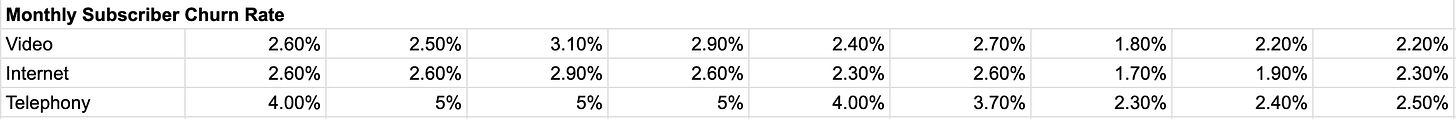

Megacable is a Mexican telecom company, owned by the Robinson Bours family (42% stake), that offers pay TV, wired phone, and broadband internet services. The company holds a concession to offer any telecommunication service nationally. This allows the company to offer its services in “bundles”, such as internet + video + phone, and internet+phone. As a result, the company can increase revenue-generating units and reduce subscriber churn rates.

The centerpiece of the company’s strategy is its internet service, which leverages its fiber and coaxial cable network to offer higher speeds than competitors at better prices. This strategy can reduce churn rates because market tailwinds such as the transition from wired phones to mobile phones, and pay-tv to streaming, have less impact on the company's operations. If users want to install an internet connection in their homes, they have no choice but to pay for the wired phone or subscribe to a triple play bundle.

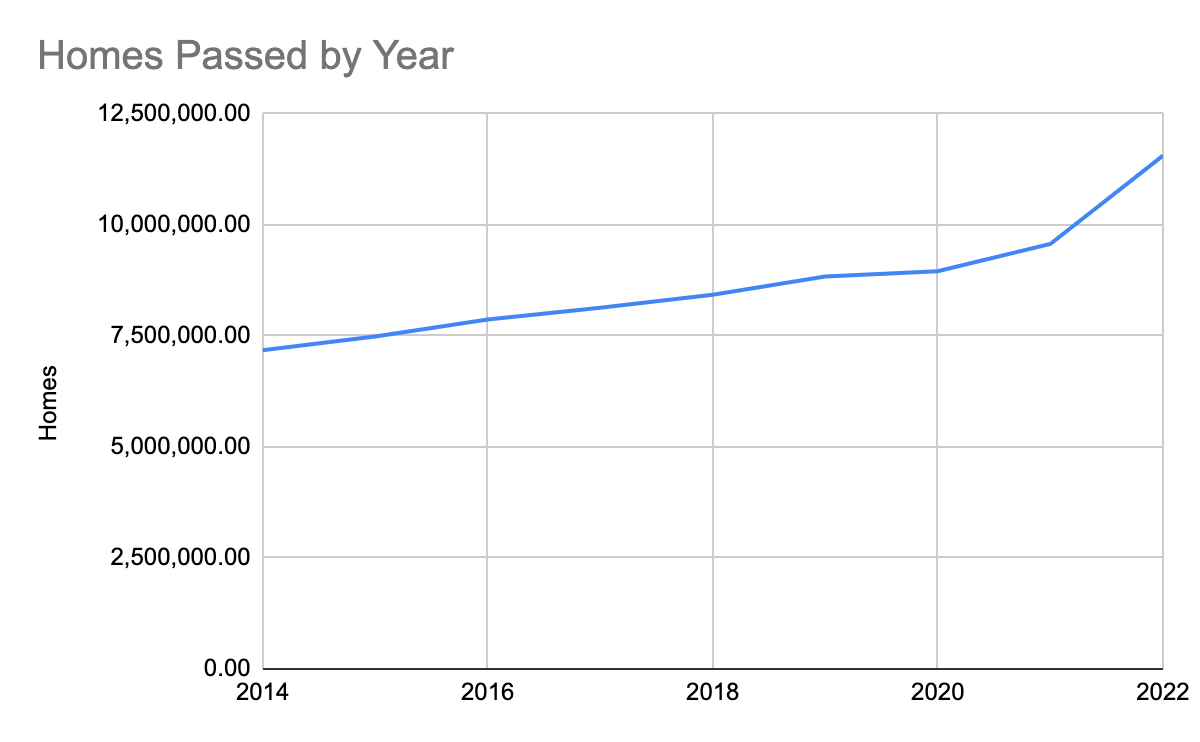

At the end of 2022, the company had 4,397,994 unique subscribers, and a network of 76,236 km–reaching 11.5M homes passed. Homes passed is a metric used to estimate the potential customers the company can offer.

The company's customers have consistently opted for the triple-play service. By the end of 2020, the subscriber base for the triple play service stood at 57%, compared to 52% at the end of 2019.

The majority of the company’s revenue is recurring. Customers pay a monthly subscription at the start of each month for their services.

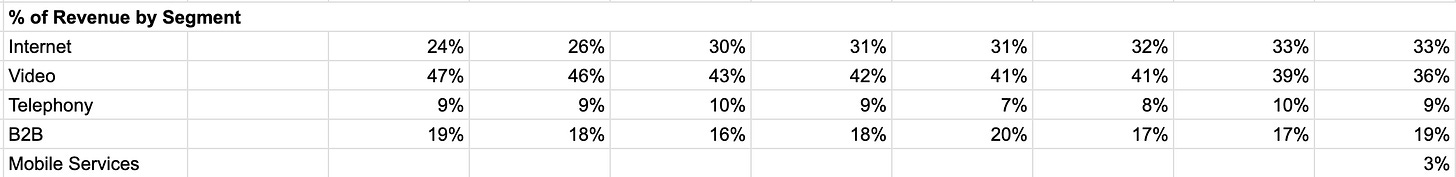

In 2022, revenue from the company’s retail segment, which includes the services listed above, was divided into 33% internet, 36% video, and 9% wired phone.

The company also generates a significant portion of revenue from its corporate segment. The company provides computer networking, consulting, and infrastructure services to corporate customers. In 2022, revenue from this segment represented 19%.

Introduction to the Telecom Industry in Mexico

TV

According to the IFT, there were a total of 16.7 million pay-tv subscribers in Mexico in 2022.

In Mexico, 95% of homes have at least one TV. 53% of homes depend exclusively on open channels to watch TV. 38% only use a pay-tv option. 9% use pay-tv and the open channels.

Televisa and TV Azteca provide open channels ("free TV"). Users can access open channels by connecting an antenna to a TV.

The pay-TV industry in Mexico principally includes DTH (satellite) and cable operators. An advantage of DTH providers is that they do not require physical infrastructure to expand their reach. However, a drawback of DTH services is that they cannot offer various telecom services through a single medium, as cable operators do. At the end of 2022, 65% of television access in Mexico was through cable.

DTH operators include Sky and Dish, with SKY holding the majority market share.

The company estimates that it holds a 20% market share of the total pay TV subscribers in Mexico.

Internet

Internet adoption continues to increase in Mexico, at the start of 2022 there were 24.1 million subscribers. According to the ENCCA (2022), 75% of people in Mexico use the internet. Being broadband access (wi-fi) the most popular access type. The main environments where people use the internet are home, work, home of acquaintances, and school.

Internet providers such as America Movil leverage their telephone lines (DSL) to offer internet services. The company has a technological advantage over these competitors because coaxial cable and fiber networks can offer higher internet speeds than DSL (copper) networks.

The company estimates that it holds a 15% market share over the total subscribers of internet broadband in Mexico.

Wired Phone

According to the IFT, there were a total of 26.6 million phone lines in Mexico.

A trend towards mobile devices is decreasing the demand for wired phone lines in homes.

The main provider of telephone services in Mexico is América Movil. Other main pay-tv cable operators, such as Izzi and Totalplay, also offer bundles that group internet services with wired phones.

The company estimates that it holds a 15% market share over the total wired phone lines in Mexico.

Analysis of Megacable’s Business

Business Performance

As mentioned before, the company makes money by selling internet, wired-phone, and pay-tv services through a monthly subscription; as well as offering a variety of services to corporate customers.

Most of the company’s revenue is recurring, providing a significant benefit to its ability to generate cash flow.

In recent years the company shifted its focus from video to the internet. Evidence of this is the company’s significant investments in building and migrating 40% of its subscriber base to a new fiber network. This initiative aims to strengthen the company’s competitive advantage, which rests on its network, to be able to provide higher internet speeds at lower prices than competitors.

In my opinion, this effort to focus on the Internet also shows management’s realization that this business segment is the one that will deliver growth and profitability for the company for many years to come. Pay TV is less profitable than before because programming costs have risen and content providers have significant leverage. Likewise, a tailwind toward adopting mobile devices has reduced the demand for wired phone lines. Up until now, the company’s internet segment has reduced churn and increased RGUs (revenue-generating units) per subscriber.

For example, the following graph shows how growth from internet subscribers has pushed the growth of wired phone subscribers because the company sells these two services together.

Moreover, in the last 10 years, the company’s operations have significantly expanded, thanks greatly to the company’s ability to finance the growth of its network from its recurring cash generation. The following graphs show the growth of the company’s revenue, highly correlated with the growth of the company’s network and homes passed, since increases in these two metrics allow for a higher number of subscribers.

Moreover, by analyzing revenue by subscriber and subscriber growth by segment, we can observe the trend of lower declining growth for video services and a greater significance for internet services.

From 2014 to 2022

Finally, we can observe how the company’s strategy to offer its services through “bundles” has increased cross-selling between subscribers and reduced churn rates.

From 2014 to 2022

Competitive Advantages

The company’s competitive advantages spur from its superior technological infrastructure that enables it to offer higher internet speeds at a lower cost than competitors; and its concession to offer any type of telecom service in Mexico. This concession gives the company the ability to offer pay TV, wired phone, and internet services. Allowing the company to offer a superior product to consumers. The long-term advantages of fiber will gradually become more and more prominent as the amount of bandwidth demand (overall and per consumer) continues to increase. The company is well-positioned to benefit from this transition.

It is important to highlight how, by being able to sell multiple telecom services, the company can increase revenue-generating units. This results in a more efficient use of the company’s network because all these services are given through it. Allowing the company to have a better cost structure because the maintenance cost of the network is less as a percentage of revenue.

It is very hard for a new competitor to enter the telecom industry due to the amount of investment necessary to build a network capable of reaching sufficient users to make a profitable business.

Currently, only a handful of competitors compete with the company in the telecom segments that it operates in.

Business Durability

The durability of the company’s operations is a key point of concern. Up until now, the company has been able to handle reduced demand declining services like pay-tv and wired-phone through “bundles”.

A regulatory change that prohibits the company from selling pay-tv or wired phones together with the Internet could have very negative implications on the company’s operations and profitability.

Main Assets

The company’s main assets are its coaxial cable and fiber network and its operating lease right-of-use assets. Right-of-use assets include the posts owned by the CFE where the company’s network passes through, and other key locations used to provide its services.

At the end of 2022, the company’s network was worth 45,775 million, and the right-of-use assets were worth 1,941 million.

Other necessary assets for the company to operate include accounts receivable and inventory.

Analysis of CAPEX Initiatives and Maintenance Capex

GPON Evolution

In 2020 the company started a project to build and migrate 40% of the company's subscribers to a fiber network (FTTH).

The purpose of this initiative was for the company to be able to offer higher internet speeds to consumers and position itself strategically as demand for the internet continues to increase. The company expects selling broadband internet will represent the majority of revenue in the future. This aligns with the company strategy to provide the highest internet speeds at the best price.

The project concluded in 2022, resulting in the construction of a 24,000 km of fiber (FTTH) network and the migration of 40% of the company's subscribers.

MEGA 2024

In 2022, the company announced MEGA 2024, a plan to reach new locations and achieve national coverage by expanding the company's network.

The goal of this project is to grow the company’s operations through the growth of its network.

In 2022, the company built more than 9,500 km of network.

CAPEX

The company’s CAPEX has significantly increased as a result of the projects mentioned above. The following graph illustrates CAPEX as a percentage of revenue from 2014 to 2022.

Based on the company’s depreciation expense I expect that maintenance capex, the necessary spending to return the company’s assets to their status at the end of the year, is around 20% of the company’s revenue. Depreciation as a percentage of revenue was 19.3%, 19.6%, and 21.4% from 2019 to 2022, respectively.

Profitability

I analyze the company’s profitability by comparing its cash earnings to the amount of capital used to generate them–Return on Invested Capital.

Based on the company’s net operating income after taxes, the cash earnings a company would have if it had no debt or excess cash. And the company’s invested capital, the assets that are necessarily employed by the business to generate NOPAT. The company’s return on invested capital is mediocre.

I estimate NOPAT by multiplying net operating income by the appropriate tax rate of 30%.

I estimate invested capital through an operating approach.

Non-Current Cash Assets - Non-Interest Bearing Liabilities + (PP&E + Operating Lease Right of Use Assets).

I exclude cash and marketable securities from Non-Current Cash Assets because they are not necessary for the company to operate. We subtract Non-Interest Bearing Liabilities, like suppliers, because they finance the company’s working capital.

Finally, I exclude goodwill and intangible assets because they do not represent tangible capital that the company uses to run its business. The company could, for example, pay too much to acquire another business and increase goodwill on its balance sheet. The value of this goodwill comes from an accounting measure and does not represent capital that is necessary for the business to run.

Based on the above, the ROIC for the company between 2019 and 2022 was 13.38%, 13.6%, 13.17%, and 10.5%. 2022 results are likely understated because of bonuses and promotions to new subscribers. However, even when they do reflect, ROIC will likely not increase much above historical results.

Conclusion

At a multiple of 6.8x earnings and 3.9x EBITDA, Mega is selling at a potentially attractive price, however, right now I do not think that there is a sufficient margin of safety considering the mediocre profitability of the business and the risk from declining demand from the segments of pay-tv and wired-phone.

For now, I will keep the company on my radar and continue to analyze how the company’s investments to expand its network affect revenue growth and return on invested capital.