Rotoplas – Analysis and Valuation

A deep dive into the monopoly we all see.

30 minute read

Reasons to Analyze Rotoplas

Great business

Leader in the water storage and conduction product categories

Clear competitive advantages: brand and distribution

Asset light business

Return on Capital Employed of 25%

Potential for growth based on macro tailwinds, including climate change, nearshoring, and Mexico’s housing deficit.

Growing business, from 2019 to 2022, sales grew at a CAGR of 13.16%.

Market Valuation of Rotoplas

Analysis Outline: How I plan to value Rotoplas

Business Understanding

Business Growth

Profitability

Reinvestment Requirements

Credit Risk

Business Opportunities

Management

Shareholder Structure

Discounted Cashflow Valuation

Conclusion

Company Information

Rotoplas is a Mexican company that primarily manufactures and sells water products in the categories of storage, conduction, and improvement. Apart from products, the company has a service segment that includes waste water treatment plants and new business initiatives. In 2022, products represented 96% of sales.

Water Storage Products

Problem

People and businesses are vulnerable to water scarcity due to draughts, contamination, and lack of water infrastructure.

Solution

A product that allows households and businesses to store water for future use. This includes cisterns, tinacos, and industrial water tanks.

Customer

Independent distributors that resell the product to the final customer. The company’s products are available at over 32,000 points of sale.

Importance for Rotoplas

In 2022, tinacos represented 25.1% of sales, with sales increasing 12.3% year over year.

Market share (Mexico): ~40%,

Driver

The construction industry, including homes, apartments, and industrial property.

Durability

As long as Mexico, Peru, Central America, and Argentina do not significantly improve their water infrastructure to properly store and distribute clean water to people, the products that the company sells will remain an attractive solution.

Low vulnerability to technological changes, the product has not dramatically changed in the last 20 years.

Competitive Advantage

Many consumers shy away from purchasing the least expensive water tanks or unfamiliar brands. This hesitation arises from the perception that water tanks, which store a vital resource for many households and are expected to last a decade, must be of high quality. Customers are willing to pay more for a brand they deem reliable. A study by Millward Brown revealed that when asked about home water solutions, 41% of respondents immediately thought of Rotoplas. Furthermore, an impressive 98.7% of the population recognizes the Rotoplas brand within the water storage segment. Due to its strong brand recognition and association with premium products, Rotoplas can command prices that are up to 20% higher than its competitors.

A significant barrier to entry in this industry is logistics and distribution. Plants producing the final water tank product can only sell profitably within a 400 km radius. This limitation makes it challenging for competitors to establish a national presence, as they would need multiple manufacturing facilities across regions. Rotoplas has a unique system: it produces accessories and various components of its water tanks in two factories. These parts are then shipped to eight rotomodelo plants where the final tank is assembled. This two-tiered logistical approach ensures materials are transported efficiently, and the final product is manufactured closer to the consumer, granting Rotoplas a competitive edge in distribution.

Marco Tailwinds

8 million housing deficit in Mexico

Defit is driven by demographics, 40% of the population is aged 24 or younger

Nearshoring due to tensions between the US and China

Prolonged draughts and hotter temperatures due to climate change

Competition

Eureka (Grupo Elementia), Aquaplas (Cemix), Rotomex (IUSA)

Water conduction products

Problem

Water needs to be transported through a medium inside buildings.

Solution

Water conduction pipes and pumps that allow water to be transported and distributed inside buildings. Rotoplas operates under the brand Tuboplus. Its conduction pipes are made from Polipropileno Copolímero Random (PPR). This material is highly resistant to hot water and low temperatures, does not have a risk of leakage thanks to its termofusion property, and protects against toxicity and bacteria. Very superior to copper and PVC.

Customer

Home improvement stores, ‘ferreterias’, and construction companies.

Importance for Rotoplas

In 2022, water conduction pipes represented 22.8% of sales, with sales in this product category increasing 17.39% year over year.

Driver

Construction of residential, commercial, and industrial properties. Demand for air-conditioning systems.

Manufacturing

The company’s water conduction pipes are made through an Extrusion manufacturing process. The company currently has 1 plant in Mexico with an annual capacity of 108 million tons, and two smaller plants in Argentina. The Mexican plant operates at 75% capacity.

Durability

All construction buildings, whether residential or commercial, or industrial, need water-conduction products to offer water services. Low vulnerability to technological changes, the product has not dramatically changed in the last 20 years.

Competitive Advantage

Tuboplus was the first company in Mexico to offer PPR water pipes. The brand is widely recognized as the leader in this segment. As a result, the company has pricing power over its competitors.

The principal barrier to entry for competitors that currently offer PVC or copper pipes and want to sell PPR pipes to compete with the company is its distribution network of points of sale and plumbers that sell and recommend the company’s products.

Tailwinds and Growth

8 million housing deficit in Mexico

40% of the population is aged 24 or younger in Mexico

Nearshoring

Expansion to Peru and Central America. In 2021 the company began selling water-conduction products in Central America.

Competition

Nacobre, Grupo Dema

Business Growth

Commentary:

Between 2014 and 2016, there was a decline in revenue due to a downturn in Mexico's low-income housing industry. The Peña Nieto administration pivoted dramatically, favoring vertical urbanization over horizontal expansion. Consequently, Infonavit realigned its strategy, offering more loans to consumers for apartments in vertical real estate projects. This shift had severe repercussions for Mexican homebuilders. Many had invested in vast expanses of land on the outskirts of cities like Cancun, Guadalajara, and Monterrey. With the government's reduced funding for new homes in these peripheral areas, the value of these lands plummeted. This financial strain led to bankruptcy for several top homebuilders, while others that managed to stay afloat became largely inactive. However, in 2017, there was a shift. Infonavit increased its loan offerings, enabling Mexicans to buy low-income houses and apartments in response to the country's housing deficit.

Following a management change in 2018, the company witnessed a Compound Annual Growth Rate (CAGR) of 10% in its revenue. From 2020 to 2022, this revenue uptick was due to several factors: double-digit growth in Argentina, an uptick in household water consumption, and extended droughts in the water-deprived regions of northern Mexico.

Profitability

Commentary

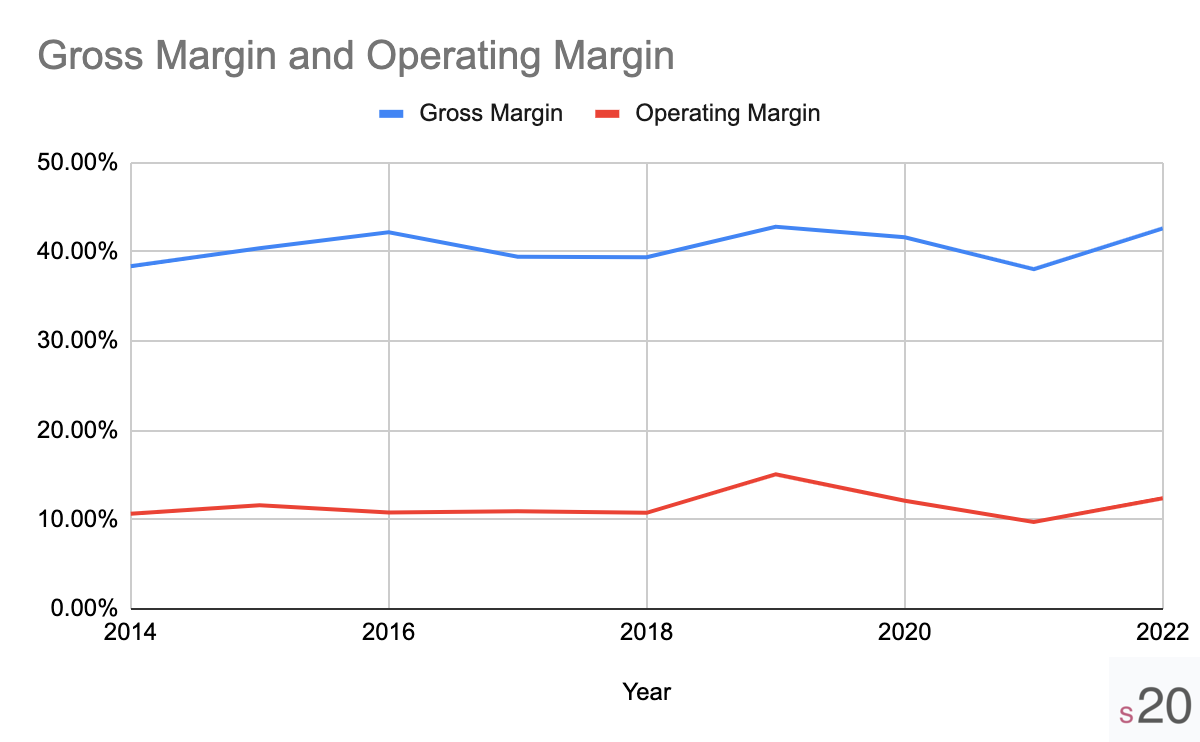

From 2014 to 2022, both gross margins and operating margins remained consistent. Looking ahead, I anticipate these margins will align with historical trends, given that the bulk of the company's revenue is projected to stem from its established product lines. This means we can expect an average gross margin of 41% and an average operating margin of 12%.

Commentary

The Return on Capital Employed (ROCE), defined as equity plus long-term debt minus intangible assets and cash, provides a comprehensive perspective on the company's profitability. This metric specifically takes into account the capital that is actively employed in the business.

Between 2018 and 2020, the ROCE experienced significant improvement. This was primarily due to the divestment of three manufacturing plants in the U.S., allowing the company to concentrate on its e-commerce and septic tank sectors. Concurrently, the company withdrew from its water storage product business in Brazil, attributed to its subpar profitability. The dip in ROCE in 2021 can be ascribed to the company's investment in a new facility in Nicaragua. This strategic move was aimed at reducing logistical costs and enhancing the company's foothold in the Central American market.

Reinvestment Requirements

Capex

Between 2020 and 2022, the company primarily directed its capital expenditure (capex) towards modernizing manufacturing plants. This was to facilitate the production of the next-generation 'tinacos' and to increase capacity for water-conduction products. In the near term, the company projects that capex will remain at approximately 5% of revenue to bolster growth in both the water products and water treatment plant sectors.

D&A

In 2022, depreciation and amortization was 3.2% of revenue.

Maintenance Capex

Based on management’s commentary, maintenance capex currently represents around 3% of revenue

Business Opportunities

Where will future growth come from?

1. Water Storage and Conduction Products in Mexico

Demographics in Mexico -> Housing deficit -> Increase demand for water storage products and conduction products

Climate change -> More water draughts -> Increase demand for water storage products

Nearshoring

-> + Industrial facilities

-> Increase demand for water-conduction and storage products

-> Increase demand for housing -> Increase demand for water storage and conduction products

2. Waste Water Treatment Plants in Brazil (Systesa)

Idea: Expand water treatment services in Brazil and create a recurrent revenue stream.

Problem: More than 50% of Brazilians do not have access to sewage networks. Proper wastewater treatment is crucial to protect the quality of natural water sources. If wastewater is inadequately treated and then discharged into a river, for instance, it can contaminate the water.

Solution: Wastewater treatment plants to treat wastewater from residential, commercial, and industrial sources. This wastewater could include sewage (from toilets), gray water (from showers, washing machines), and industrial effluents.

Context of solution: To address the country’s challenges and attract much-needed investment in the sector, Brazil passed the "New Legal Framework for Sanitation" in July 2020. This law aims to expand sewage and drinking water services to much of the country's population by the 2030s.

TAM: 800 million USD

Customer: Water-intensive industries like commercial, food and beverage, chemicals, and automotive that create wastewater.

Driver: Change in legislation that supports the creation of wastewater treatment plants.

Insight: Barrier to entry based on the high capital requirements to construct wastewater plants.

Risk: Competition

3. Bebbia in Mexico

Idea: Create a recurring revenue stream by allowing people to rent a water filter through a monthly subscription.

Problem: People do not have access to drinkable water at home. As a solution, people buy jugs of water through convenience stores or subscribe to one of the 3 main companies (bonafont, ciel, epura) and have jug water delivered to their homes. Pain points of this solution are having to go and buy a jug of water, or having to wait and receive the weekly delivery.

Solution: Purified water as a service through a monthly subscription. The company installs a water purification system in the customer’s home or business and charges a monthly subscription to use it.

Results: 92,000 subscribers

TAM:

3 M households (B2C)

1 M institutional clients (B2B)

500 M USD in annual recurring revenue

In 2022, the jug water market represented around $2 billion in sales in Mexico.

Driver: Lack of clean water infrastructure in Mexico.

Durability: As long as Mexico does not significantly improve its water infrastructure to properly distribute drinkable water to people, people will need to buy jug water or have a filtering system at home.

Insight: Customer captivity. Once a user adopts Bebbia, changing to a competitor is hard because the subscription cost is low vs the value the customer gets. Additionally, to change, the customer needs to schedule for a technician to come and take the equipment.

Scalability: A technician needs to go to a customer’s residency or business to install the water filter. A technician also needs to visit the customer’s place every 6 months for maintenance. As a result, subscriber growth will be linear–relative to the amount of technicians the company has to install water filters. This also means that the company needs to invest in transportation vehicles for technicians to go to the customer’s homes, and in the technology to find the best routes.

Risks:

The customer cancels the subscription but does not allow the technician to come and pick up the filter.

The barrier to entry is relatively low for new competitors. It is easy to order and sell filters as a subscription, what is difficult is investing in the infrastructure to profitably grow and give maintenance to users.

4. Septic Tanks in the USA

Idea: Expand the septic tanks business in the USA

Problem: 20% of residencies in the USA are not connected to the drainage system.

Solution: Septic tanks collect sewage and decompose it through bacterial activity. They are used to treat human waste and separate solids and liquids in wastewater.

Customer: Residential homes not connected to the drainage system.

TAM: 6 billion USD

Risks: New competition

Credit Risk

Indebtedness

The company sold bonds totaling $4,000 million pesos in 2017 (AGUA-17). These bonds have a fixed interest rate of 8.65%, with the principal due in 2027.

Fitch, AA(mex), expects that the company will not need to raise outside capital to fund reinvestment needs. In the case it needs to, the company can stop distributing money to shareholders to strengthen its position.

Standards and Poor, mxAA-, considers the company’s financial position to be exceptional given that it does not have significant short-term obligations and has access to credit lines.

Leverage metrics

Net Debt / EBITDA: 1.74

EBITDA / Interest coverage: 7.4

Financial expenses

Management

Focused on delivering growth that adds value to shareholders

The interests of the management are closely aligned with those of the shareholders, as evidenced by their significant stakes in the company:

Carlos Rojas Aboumrad (CEO): 18.45%

Carlos Roberto Rojas (Founder and President): 11.12%

Mario Romero Orozco (CFO): 1.45%

Excellent transparency and communication about present and future results

Excellent reputation according to a trustworthy source that knows Carlos

Shareholder Structure

Principal Shareholders: 64%

Directors and relevant executives: 4%

Repurchase fund: 11%

Float (investment public): 21%

Discounted Cashflow Valuation to the Firm

Revenue assumptions

10% year-over-year growth from 2023 to 2027

3% growth after year 5.

Reasoning

I anticipate that Rotoplas will leverage its market leadership and renowned brand to tap into future demand for water storage and conduction products. This demand will be fueled by macroeconomic tailwinds such as the ongoing housing deficit, climate change impacts, and nearshoring trends. Furthermore, Rotoplas' strategic expansion of its conduction business into emerging markets like Central America and Peru promises to catalyze growth. In addition, the company's diversification into new ventures—namely water treatment plants in Brazil, the Bebbia initiative in Mexico, and septic tanks in the USA—will likely augment its growth trajectory.

Operating Margin

I anticipate Rotoplas will uphold its average operating margin, consistent with the trends observed from 2017 to 2022. This expectation stems from the durability of the products the company offers, coupled with the projection that a significant portion of the company's revenue will continue to derive from its core product line. While this perspective may shift over the next decade, it remains challenging to predict the success of new business initiatives from the services segment. As it stands, this segment accounts for a mere 3% of total revenue, making it uncertain whether it will evolve into a pivotal component of the company's operations in the future.

Reinvestment Needs

I project that from 2023 to 2027, capex, as a percentage of revenue, will stand at 5%. This forecast is based on the company's continued commitment to amplify production capacity to meet growth demands and the pursuit of new business ventures.

It's noteworthy that the current operating margin already includes a Depreciation & Amortization (D&A) charge, of approximately 3% of revenue. This figure closely aligns with the company's maintenance capex. As a result, our adjustments will only account for an additional reinvestment requirement equivalent to 2% of revenue from 2023 to 2027. After year 5, I anticipate a deceleration in growth, leading to a subsequent reduction in the company’s capex, bringing it back down to the current maintenance level of 3% of revenue.

Currency Conversion

Average currency conversion expense from operations in Argentina from 2017 to 2022.

Cost of Capital

The opportunity cost, when considering my investment options, is benchmarked against my present best alternative: CETES 28. This instrument offers an annual return of 11.40%.

Valuation

Commentary

At an enterprise value (EV) of 14,139 million pesos, Rotoplas would trade at 7 times its EBITDA. I believe this multiple provides a reasonable estimate of the company's intrinsic value, taking into account its growth potential, the competitive strengths of its brand and distribution, and the industry in which it operates.

Conclusion

Regrettably, based on the current market valuation of 16,178 million pesos in enterprise terms, investing in Rotoplas doesn't provide a margin of safety. However, considering the company's management and the nature of its business, I will certainly keep this company on my radar.