The Fallacy of Expected Value in Investing: Arithmetic vs Geometric Mean

In this article I analyze how certain investments, even with a positive EV, can lead to ruin because a large loss can occur that leads to irreversible consequences

10 minute read

Intro

This week I listened to an interview from Guy Spier where he talked about expected value and how in some situations, even if an investment has a positive expected value, if taken repeatedly, it could lead to ruin because a large loss can occur that leads to irreversible consequences.

Expected Value

Expected value is the average outcome you would anticipate from an investment or repeated bet over time, taking into account the gains and losses weighted by their probabilities. In an EV calculation, you are assess how much you can win and the probability of that vs how much you can loose and its probability, and then add those figures and compare them to the initial amount.

Knowing if an investment has a positive expected value is very useful because it allows you to know if the outcome will produce an overall reward. Generally, situations with a positive expected value provide good risk and return characteristics.

Coin Flip Example

Take a coin flip, you lose 40% of your money if it lands on tails and gain 50% if it lands on heads. Assuming you start with $1, is this a bet you would want to take?

Calculation:

Probability of heads = 0.5

Probability of tails = 0.5

If the coin lands on heads, you gain 50%, so your new amount is:

1 + 0.5 * 1 = 1.5

If the coin lands on tails, you lose 40%, so your new amount is:

1 - 0.4 * 1 = 0.6

The expected value (EV) of this coin flip can be calculated as followings

EV = (0.5 * Gain on heads) + (0.5 * Loss on tail)

EV = (0.5 * 1.5) + (0.5 * 0.6)

EV = 0.75 + 0.3 = 1.05

The expected value is 1.05, which means that, on average, you would have $1.05 after each flip. Since the expected value is greater that the initial amount of $1, this situation has a positive expected value.

Counter-Argument - Geometric mean

At first glance, you would want to make this investment all day long.

However, this is only true if you can you can continue to bet without limit, each time with the initial amount.

Investing does not work this way because your capital is limited and results compound. A lose of 40% of your money can be very bad and cause irreparable damage.

Situations like this require a different approach because the sequence of gains and looses have an important effect on the overall outcome. For this, the geometric mean is very useful, it considers the product of gains over multiple periods, and the fact that a large loss can have a more significant impact than a large gain.

If we look at the coin flip bet and consider multiple coin flips, the geometric mean provides a better sense of the expected value over time.

Here, the geometric mean is 0.95, which is less than 1. This means that, in the long run, each coin flip actually decreaes your wealth by about 5% on average, despite the arithmetic mean suggesting a gain.

The key insight here is that while the arithmetic mean suggests a favorable outcome, the actual compounding effect over time results in a loss, leading you to ruin.

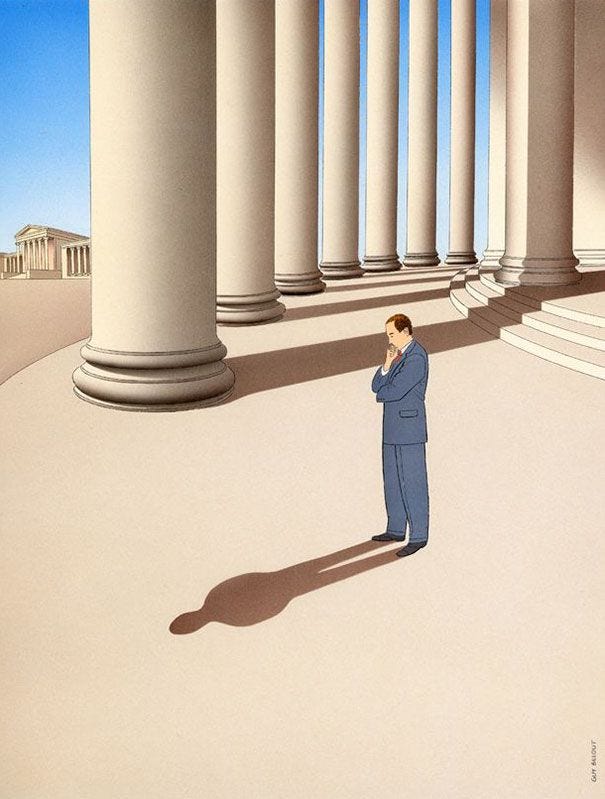

The following graphs demonstrates this phenomenon. Despite the arithmetic mean suggesting a potential average gain, the geometric mean demonstrates how your wealth declines over time. This happens because the loss out weights the gain, and future gains are unable to recover past losses.

These graphs highlight why the geometric mean in more realistic for evaluating scenarios where results compound.

Ergodic vs Non-Ergodic Systems

The law of large numbers applies differently in ergodic versus non-ergodic systems.

In ergodic systems the expected value is useful because things will average out. Over many trials, what happens to an individual will look like the average of the entire system or group. Here the law of large numbers and EV applies neatly.

However, in a non-ergodic system, the experience of a single individual can be very different from the average of the entire group. Even if the expected value is positive, the outcome for someone can be very different because of the sequence of events. Once you lose a lot of money, it may be impossible to get back to where you started.

In non-ergodic systems, focusing on avoiding ruin is more important than seeking the highest possible return.

Skiing Analogy

The sport of skiing down a slope is a non-ergodic system.

Skiing faster may lead to a better score, however, it also increases the risk of a crash. If you crash badly, you might injure yourself and not be able to ski for the rest of the season, causing an irreperable loss. Thus, the faster skier does not win the season, the winner is the fastest skier who does not get injured.

Skiiing is similar to investing in the sense that if you face a severe enough loss, it can be difficult or impossible to recover. So, managing risk to being able to stay in the game is the most important thing. Survival is everything.

Effect on my Investment Approach

Learning about the difference between ergodic and non-ergodic systems definitely changed my view on diversification, risk, evaluating investments, and focus on avoiding losses.

The fact that an investment might have a positive expected value, but lead to ruin in the long run is very eye opening.

This deepens my belief that focusing on avoiding ruin and having downside protection as the center of my investment approach is crucial for investment success.

Furthermore, when investment in special situations and mediocre businesses selling at a significant discount, managing risk through diversification is important. Diversification minimizes the chance that a single bad outcome will causes irreparable damage.

Finally, I could not help but connect this to my current investment in Cultiba. An investment in the company has a very positive expected value, but current liquidity problems at Grupo Gepp are worrying. If Grupo Gepp were to go bankrupt, then a significant portion of my portfolio would be compromised–I would lose 50% of my investment. This investment started out being ergodic, but now with the presence of a risk of bankruptcy from Grupo Gepp, it has turned non-ergodic.

Summary of Insights

A situation with positive expected value can still be a bad investment because a large loss can occur that leads to irreversible consequences. If played repeatedly these types of scenarios can lead you to ruin because you fall into a situation where future gains are unable to recover present losses.

The law of large numbers applies differently in ergodic versus non-ergodic systems.

In ergodic systems, things will average out to the expected value.

In non-ergodic systems, the arithmetic mean (simple average) might show a positive outcome, but this does not accurately reflect reality for individuals who experience compounding effects. The geometric mean provides a better representation because it takes into account how the sequence of gains and losses affects overall wealth.

In no-ergodic systems, the outcome of an individual can differ a lot depending on the sequence of events. Think of the skiier, if you crash badly once you might be out of the season or your entire career. In these systems, focusing on avoiding ruin is more important than seeking the highest possible return.

Focusing on Avoiding Ruin: In a non-ergodic system like investing, avoiding large, irreversible losses is crucial.Avoid scenarios where you lose so much that you cannot recover.

Deeply understand the mistakes of other investors to avoid them. I want to understand where I am going to die so I never go there.

Diversification to Manage Non-Ergodicity: Minimizes the chance that a single bad outcome will cause irreparable damage by investing up to 10% of my portfolio per investment. So the amount that I bet is not fatal if the investment does not work out.

Investment situations in great companies are much forgiving because they are ergodic.

Investments can start being ergodic and turn non-ergodic.

New investing question to understand if the investment situation is non-ergodic: Is the investment situation non-ergodic?

Sources

Guy Spier Interview:

Thanks for an insightful article!